Signature loans makes it possible to grab the reins of the financial upcoming. If or not you qualify for a personal bank loan depends on multiple activities, certainly one of and that is your earnings. Loan dimensions, title length, credit history, expenditures, almost every other financial obligations in addition to method of getting security can be associated. Each financial provides their own program, that could by itself feel flexible.

In short, there aren’t any effortless answers when it comes to just how much of financing you can get having a good $40,000 income. Yet not, knowing the procedure will assist you to place your best foot forward when making an application for a loan. Continue reading to obtain the complete picture of just how income adds in order to consumer loan behavior.

How come a $40,000 income influence the loan amount?

A great $40,000 per year salary places you during the a good updates so you can become approved for a personal loan when you have a good credit score together with restricted loans and costs. As you can put on into the amount borrowed you would like, it’s completely up to the financial institution how big off that loan giving together with words. There is no universal formula that lenders use to calculate mortgage number and you may approvals. Try the loan calculator because of the OneMain to determine a loan proportions and you can monthly payment you really can afford.

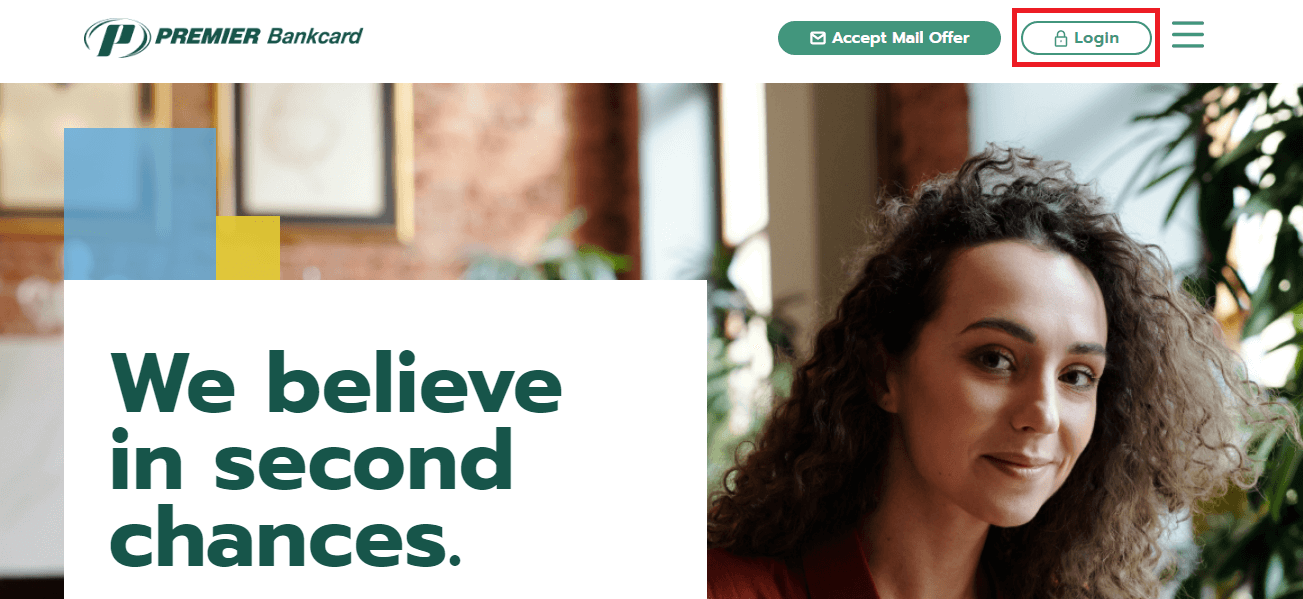

Because for each and every financial keeps their particular standards and processes, you could shop around for the ideal fit. Get a hold of a complement for your novel finances by getting pre-accredited very first. It will not affect your borrowing and will make it easier to zero for the with the mortgage that’s right to you. Lenders such as for instance OneMain Economic ensure it is easy to see for individuals who prequalify for a financial loan on the web.

New role cash within the financing conclusion

Whenever you are loan providers look at the financial health holistically, discover a couple an approach to think of just how your income things during the:

Debt-to-money proportion (DTI):This might be a monetary size you to definitely measures up their month-to-month debt repayments for the disgusting month-to-month earnings. Even in the event not at all times officially “debt,” such things as lease, home loan, credit card repayments, other money and utility repayments compensate your monthly “debt” costs. Was calculating the DTI you to ultimately obtain a good concept of exactly how much regarding a personal bank loan you really can afford with a good $forty,000 a-year paycheck.

Positive income trends: Money consistency may also give you more attractive in order to lenders. If the income might have been constant as well as growing on prior while, which may be more desirable than if you have just already been a great $forty,000 occupations. Lenders like to see that you’re capable of making repayments for the the long term as well as the present.

Where do I have a personal loan to own a paycheck of $40,000?

In terms of personal loan lenders, you’ve got choices. Financial institutions, borrowing from the bank unions and you may situated on the web loan providers can be most of the bring a mellow techniques and you can aggressive terms.

Financial institutions and you may credit unions: The school you already lender with is going to be a convenient lay to begin the loan lookup. not, online loan providers one concentrate on personal loans could well be an effective solution if you’re in the process of building debt wellness.

Individual lenders: Lenders eg OneMain Economic attract greatly with the unsecured loans. Very personal lenders strive to profit open to people who need it, even though these include in the process of strengthening their cash. Browse several loan providers to see what forms of pre-licensed now offers would be available to you. Or get in touch with a loan professional simply to walk you through the process. For those who have ongoing questions regarding signature loans, read this article on which a consumer loan are and you will isn’t really.

Economic coverage starts with economic learn-exactly how

A personal loan and a $40,000 annually paycheck are perfect tools for working toward the new upcoming. However, money is but one bit of the latest puzzle. Should tighten up your financial allowance? Preserving to have a home? Must start spending? Whatever the second level of your finances turns out, our 100 % free articles toward sufferers instance credit scores, using, and you may cost management can help you reach your wants.

All the info in this article exists to have general studies and you will informational intentions only, without having any show otherwise suggested warranty of any sort, including guarantees off reliability, completeness otherwise exercise for sort of goal. This is not supposed to be and does not compensate financial, judge, income tax or any other pointers specific to you personally the user or anyone else. The businesses cash advance america in Mill Plain Connecticut and individuals (other than OneMain Financial’s sponsored couples) described within content commonly sponsors regarding, do not promote, as they are maybe not if you don’t associated with OneMain Monetary.