- No credit monitors

- Shorter attract purchased the life of one’s financing

- Maintain your current interest rate

- No highest settlement costs of this refinancing

- Zero extended app process

- Not given by all loan providers

- Unavailable for everybody home loan items

- Need make the very least lump-share payment reduction of the primary

Calculating mortgage recast

Before given mortgage recasting, it is a smart idea to estimate exactly how recasting varies your own monthly mortgage repayments. Of a lot internet provide home loan recast hand calculators that enable you to strike about number to check out your brand-new monthly payment. Although not, calculating it by hand is achievable. You start because of the finding out your dominating kept on the mortgage. Deduct the amount of the lump-contribution payment to give another type of dominant balance. Then, utilising the conditions and interest of the most recent financing, determine the brand new payment per month.

Such as for example, if you have a thirty-year repaired financial that have a balance out of $two hundred,000 and you can mortgage loan away from 4.99%. Your payment per month are $step 1,072. If one makes a lump sum payment regarding $40,000, which will bring your dominant down seriously to $160,000, reducing your payment to $871.

If you are in some money or decided to dip to the deals, and also make a large lump-contribution percentage and you can recasting the mortgage will save you money in attract repayments over the overall, along with lower your month-to-month expenses. In the Hero Domestic Apps, we understand that recasting otherwise refinancing can seem to be overwhelming for borrowers. All of us is here now to resolve any inquiries which help you can see new refinancing or recasting option that is best suited for your means. For additional information on how exactly we might help, plan a visit with our company now.

A home loan recast occurs when a borrower helps make a large, lump-share fee on the the main of the mortgage, causing that loan reduction you to reflects the new balance. Let’s look closer from the exactly what a mortgage recast is actually as well as how it truly does work to determine if it can make feel to suit your problem.

Meaning and you can Illustration of a home loan Recast

A mortgage recast occurs when your financial recalculates the brand new month-to-month repayments on your financing according to the a great harmony and you may leftover label. Tend to, if you are thinking about recasting their financial, you’ll set-out a lump sum of cash towards the main. If you’re your rate of interest and you may title will continue to be a similar, the financial institution will then calculate another monthly payment considering the reduced balance.

- Alternative label: Re-amortization

Let’s say their brand new mortgage was having $200,000. You has just gotten an advantage working and decide to expend an extra $15,000 into the main. You happen to be now on track to pay off your mortgage in the course of time that have an identical payment per month amount. Whenever you are finding a lowered payment, yet not, you might pose a question to your lender so you can recast your balance across the remainder of your loan.

Exactly how a home loan Recast Functions

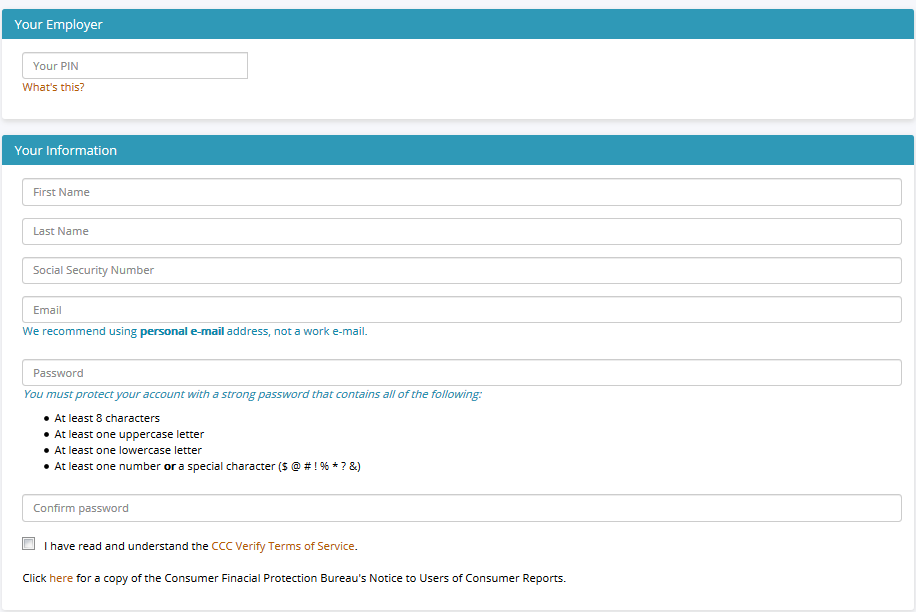

Once you decide you want home financing recast, contact their bank to find out if or not a home loan recast is possible. When it is, inquire further in regards to the lowest number you need to lay out, then carefully complete the mortgage recast software from your own lender and create your swelling-contribution fee.

Their lender will likely then reconstitute their fee plan towards the rest bad credit loans no proof of income of your financing term to help you account for the latest lump-sum percentage. The word and your rate of interest will stay the same, but your monthly premiums could well be all the way down.

Financial recasts are just getting old-fashioned money. If you have a federal government-backed financial such as for instance a keen FHA, Virtual assistant, or USDA mortgage, it will not qualify for an excellent recast.