What exactly is A house Equity Loan?

Property collateral loan try a studio shielded of the unutilized security regarding the borrower’s head family, vacation family, second domestic, or any other land the debtor possess. You could potentially borrow it as a primary, 2nd, or third financial, home guarantee credit line (HELOC) or refinancing towards a home loan-free property. You can get a home collateral loan off various other lenders, plus big finance companies, credit unions, monoline home loan team, individual financial team or any other lenders giving financial activities. Inside normal circumstances, whenever a debtor claims that they you need a home equity financing, they suggest tertiary or second credit close to the first otherwise 2nd home loan.

A debtor making an application for a home security financing constantly aims to help you receive some funds regarding the guarantee of the existing family, cottage, otherwise homes.

Consumers who apply for domestic guarantee money Toronto make use of the fund for different intentions such debt consolidation reduction, using tax arrears, committing to a separate property, buying university fees, fixing cash flow problems, funding take a trip agreements, paying down knowledge money although some.

The money given to the newest applicant is actually secure from the mortgage of the present house. Most of the time, a property guarantee loan is in the next if not 3rd condition about the existing home loan. Thus, lenders, people, or other institutions that provide domestic collateral finance deal with increased chance than initially mortgage lenders. Making use of their greater risk, domestic security funds possess higher cost than simply very first mortgage loans along with most other fees.

Family collateral money provides a less complicated and shorter software process since the they realize an asset-depending lending means, instead of an initial home loan. Individual people and personal home loan organization constantly explore its private finance whenever investment household equity finance, apart from HELOCs, personal lines of credit, and you can family guarantee finance given from the conventional organization loan providers.

- LTV otherwise mortgage in order to value (Here is the count and you can percentage of guarantee that will are unencumbered just after financial support the newest applied amount borrowed)

- The modern worth of

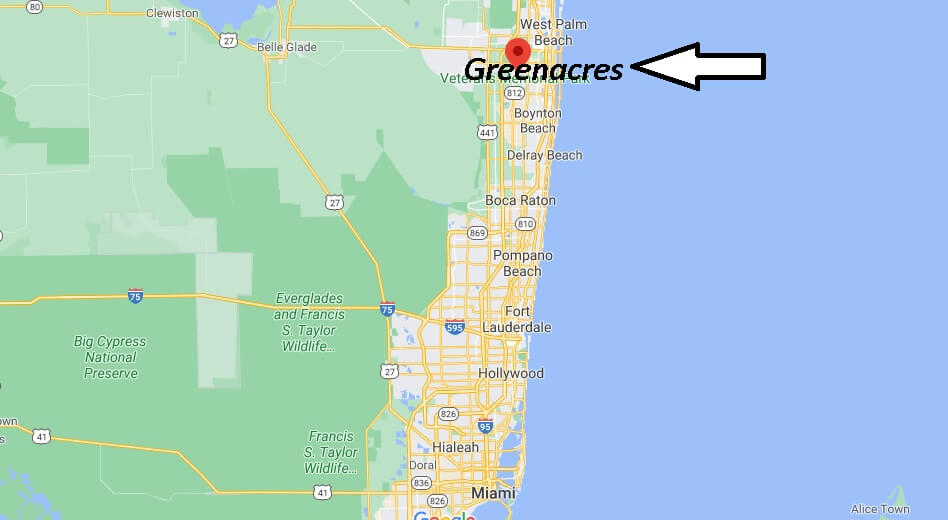

- The newest residence’s area

- Brand new property’s status

Contrary to a familiar presumption, you could get a house security loan whenever you buy your domestic. People assume that you have to await half a year in order to annually immediately after to shop for a property before applying to possess another financial otherwise HELOC, however, it is not correct.

A property guarantee financing Ontario helps you improve your financial disease. But not, it might along with ruin your bank account if not perform it safely. It is essential to have a borrower getting a strong bundle for making use of, controlling, and you may repaying this new finance offered thanks to a house equity mortgage.

Let us Start-off

You will want to find the help of an educated and you will educated home loan representative Pennsylvania loans so you’re able to using this type of equation. An established large financial company in the Toronto is prepared to give you support from the beginning towards the avoid, helping you see the money you owe as well as your coming economic specifications. This new agent will additionally suits your with an established financial who will provide you with the best rates and you will conditions available on the market.

Lately, particularly for the start of COVID 19, most people are borrowing contrary to the equity found in their qualities just like the a supply of money. People need are house on lockdown, and you will businesses are signed; therefore, money try lower. not, most other expenditures including property tax, rent, credit card bills, private income tax, and other varying costs remain unchanged. In such circumstances, owners of property or any other qualities will benefit on the information out of a large financial company into the Toronto one focuses home based security financing.