All over the country, so it group away from price incisions may benefit 50 mil domiciles and you can 150 billion individuals, cutting home attention expenses by the an average of 150 billion RMB per year.

Positives accept that the speed slashed to have present housing finance will help individuals then lose its financial focus expenditures, increase individual determination to expend, balance homebuyer standard, and increase trust.

Established property loan consumers will be able to gain benefit from the positives in the group changes by the October 31st at the earliest.

With respect to the “Step,” commercial finance companies are usually required to evenly use batch improvements in order to existing houses loan rates of the October 31st.

Reporters have learned you to Commercial and you will Industrial Financial off China (ICBC) will make sure the conclusion regarding group improvements by the October 31st, whenever you are Farming Bank from Asia (ABC) often apply uniform batch modifications just before Oct 31st.

Question Five: Exactly what actions manage borrowers need to take?

Reporters discovered you to definitely major industrial financial institutions are generally expected to launch outlined functional direction no later on than Oct twelfth to deal with customers concerns timely.

When you look at the , China conducted a batch variations out-of houses financing pricing. Really commercial financial institutions found new modifications demands of consumers owing to on the web channels including on the internet financial and you may mobile banking which have good “one-click procedure” processes, versus requiring consumers to execute a lot more cutting-edge surgery traditional, resulting in a soft buyers feel.

Concern Four: How commonly this new changes out-of present property financing cost with the some other repricing schedules become treated?

Due to the fact for every borrower keeps an alternate loan repricing date, the new costs for various borrowers vary following the group improvement.

Professionals signify the key reason into the rate decrease once this new batch changes is actually a decrease in new markup rates so you’re able to -29 basis points. But not, immediately after repricing, the speed reduced total of the most up-to-date costs stage of the Loan Primary Rates (LPR) will also be reflected. Borrowers doing that it batch changes gets their costs modified to the exact same top.

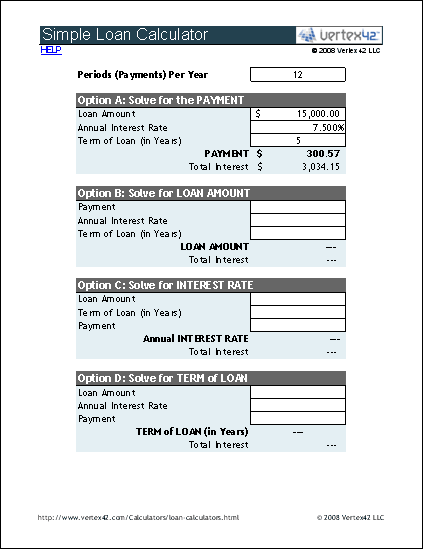

Individuals with assorted repricing times is consider the following dining table to determine their own existing homes mortgage rates variations state.

Such, of course a batch changes into the October 31st, toward latest 5-seasons LPR at the time of October twenty-first following main financial plan rate drop-off because of the 0.dos percentage situations, losing regarding the latest step three.85% to 3.65%. Given that 5-year LPR features diminished of the a maximum of 0.thirty-five fee products for the March and you can July this year, getting present houses funds repriced with the January initial, the speed next batch adjustment will be step three.9% (calculated according to good cuatro.2% LPR), while the speed following the repricing of your LPR on January initially next year could well be 3.35% (calculated according to an effective step three.65% LPR).

Concern Half dozen: Exactly what preparations have been in place for the newest much time-term apparatus?

Reporters have learned this particular will be the final batch modifications regarding existing housing loan pricing into the ChinaIn the long term, China will determine a lengthy-term apparatus to the steady and you can planned changes out of existing casing financing rates.

“Because the term from property loan deals can be a lot of time, a fixed markup speed you should never echo alterations in borrower credit, market likewise have and consult, or any other circumstances. While the markets state alter, it is easy on the interest rate differential ranging from the fresh and you can dated homes loans so you can expand.” Another certified on central bank reported that its necessary to optimize the fresh new organization structure so you’re able to facilitate industrial banks and you can borrowers to modify deals during the the ideal trends.

To deal with one another immediate and you can fundamental products and you will eventually resolve the brand new dilemma of interest rate differentials ranging from the newest and you may dated houses loans payday loans Murrieta, the fresh new central financial will establish a long-label device toward gradual and you can organised improvement out of present construction financing interest rates.