New knowledge on this page are powered by CCH AnswerConnect, Wolters Kluwer’s industry-leading income tax research services. As such, a few of the hyperlinks one of them post end up in subscriber-merely CCH AnswerConnect stuff. Having entry to these types of insights, sign in otherwise register for a politeness trial. For people who fudged the details on your own Salary Cover System (PPP) loan forgiveness software, your ount.

Borrowers need satisfy standards getting PPP loan forgiveness

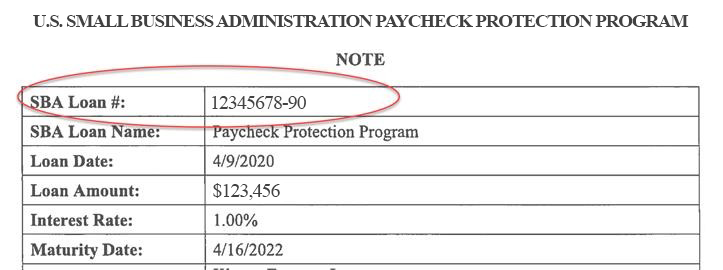

New federal government’s Small company Government instituted the fresh PPP mortgage program to add recovery to help you businesses influenced by COVID-19. The new program’s purpose were to let organizations keep the team operating from inside the crisis. In the event the taxpayers meet certain requirements, the brand new loans is forgiven. Essentially, forgiven money is nonexempt because release of financial obligation money. Yet not, a good taxpayer ount away from a qualified PPP loan.

Depending on the Internal revenue service, in terms of the brand new PPP loan system, lenders is forgive a full number of the mortgage if for example the financing receiver match three conditions:

- The newest person is permitted have the PPP financing.An eligible mortgage individual is a business question, independent company, eligible thinking-functioning individual, sole manager, business matter, otherwise a specific variety of taxation-excused organization that has been (a) running a business to the otherwise ahead of , and you can (b) had group otherwise independent builders who had been purchased their characteristics. Self-operating somebody, just people, and you can separate contractors also are qualified users.

- The mortgage proceeds were used to invest eligible expenses. Eligible expenses is things including payroll will set you back, lease, attention towards the business’ home loan, and resources.

- The mortgage receiver removed loan forgiveness. The mortgage forgiveness application required that loan recipient to help you vouch for eligibility, ensure specific financial recommendations, and you can see almost every other legal official certification.

If an effective taxpayer suits the newest requirements more than, the fresh new taxpayer ount of your own PPP loan out of money. In the event the conditions aren’t came across, the brand new taxpayer need is given that taxable earnings the fresh percentage of forgiven PPP loan proceeds which do not meet up with the conditions.

Misrepresentations discovered by the Internal revenue service

The fresh new Irs states many PPP mortgage recipients exactly who gotten mortgage forgiveness was basically accredited and you can made use of the mortgage continues properly so you’re able to spend qualified expenses. But not, the brand new Irs has discovered that some receiver exactly who acquired financing forgiveness failed to meet one or more qualifications requirements. According to the Irs, these recipients received forgiveness of the PPP loan because of misrepresentation or omission and you may possibly failed to meet the requirements for an excellent PPP mortgage or misused the loan continues.

Eg, assume that Questionable are a qualified small company one received good PPP mortgage, however, don’t use the mortgage proceeds getting qualified expenses. The business removed forgiveness of their PPP financing from inside the 2020 as if it absolutely was entitled to loan forgiveness. In its loan forgiveness application, Shady didn’t are all the relevant issues who mean that it was not entitled to a qualifying forgiveness of the PPP mortgage. According to research by the omissions and you will misrepresentations with the app, the lender accepted the program, and Debateable obtained forgiveness of their PPP loan. Once the PPP mortgage forgiveness are according to omissions and you may misrepresentations, the loan will not slip inside the extent regarding loans you to is forgiven. Questionable, therefore, may not exclude the mortgage forgiveness away from revenues.

Taxpayers advised so you can follow. if not

The new Internal revenue service is urging taxpayers just who wrongly acquired forgiveness of its PPP money when deciding to take measures ahead on conformity. They can do that, particularly, because of the filing revised production that are included with forgiven financing just do it wide variety during the income.

As well, from the terms away from Irs Commissioner Chuck Rettig, We need to make sure individuals who are abusing payday loan Winsted instance apps take place responsible, and we’ll be considering all the offered medication and you will punishment channels to deal with the abuses.