GoodFinancialCents have a marketing relationship with the companies integrated in this article. Our articles lies in mission study, in addition to opinions is our very own. For more information, excite below are a few our very own full disclaimer and you can over directory of people.

These types of reviewers was globe leaders and top-notch writers just who continuously contribute so you can legitimate courses like the Wall structure Roadway Diary therefore the Ny Moments.

Our very own expert writers opinion the blogs and you can strongly recommend change to ensure our company is maintaining our very own large requirements to have reliability and you will professionalism.

All of our professional reviewers keep complex grade and qualifications and also have decades of experience with personal cash, old-age think and opportunities.

This type of writers is actually globe management and you will elite group editors who continuously contribute so you’re able to reputable books such as the Wall structure Roadway Record and New york Moments.

Our pro reviewers feedback the stuff and you may suggest changes to make sure the audience is maintaining our very own highest standards having accuracy and you may reliability.

Our expert reviewers keep state-of-the-art degrees and you can qualifications and then have decades of experience having individual finances, old age think and you can expenditures.

The fresh median price of land sold in Georgia is actually $183,700, with home values have increased eleven% in the last seasons, centered on Zillow.

Mediocre number costs are likely to remain its upward trajectory thank you so much for the upsurge in Atlanta’s national financial importance as the an enthusiastic epicenter having flick, tech, news communication, and financing.

Statewide, the sales costs away from Georgia’s property are less than half off the latest federal amount of $436,800, centered on with respect to the St. Louis Given FRED Monetary Analysis.

The standards affecting current home loan cost in the Georgiawe.age., ascending urban populace thickness, affordable land from inside the outlying elements, tech-markets increases, and you can group shiftslead to a special and welcoming home environment to own possible homebuyers.

7 Important Factors Which affect Mortgage Cost & Refinance Prices inside Georgia

Whenever surveying home loan costs in Georgia, borrowers may find extreme variations in the newest estimates it receive. This is due to financial-certain criteria, regional a home demands, and you will fundamental monetary exhibitions that can help influence mortgage qualifications, mortgage quantity, and you may style of interest rates.

Bear in mind, its smart to research, compares, and discuss mortgage terms. Below are eight facts you to borrowers should keep planned whenever assessing its financial choices:

Financing identity

Living, otherwise length, of the mortgage plays a vital role in the manner interest levels are decided. As an instance, a timeless 30-12 months fixed-rates mortgage form a borrower have thirty years to pay straight back a lender, a long period that will potentially end up being fraught with specific risk on the lender’s vision.

As a result, prolonged mortgage words have a tendency to include large mortgage pricing. However, a shorter-label mortgage of, state, fifteen years, is far more probably be a) repaid ultimately, b) cover a more substantial down payment, and you may c) wanted increased monthly payment.

For these reasons, less funds is generally considered safer having in a position to individuals, ultimately causing a bit down interest levels.

Credit rating

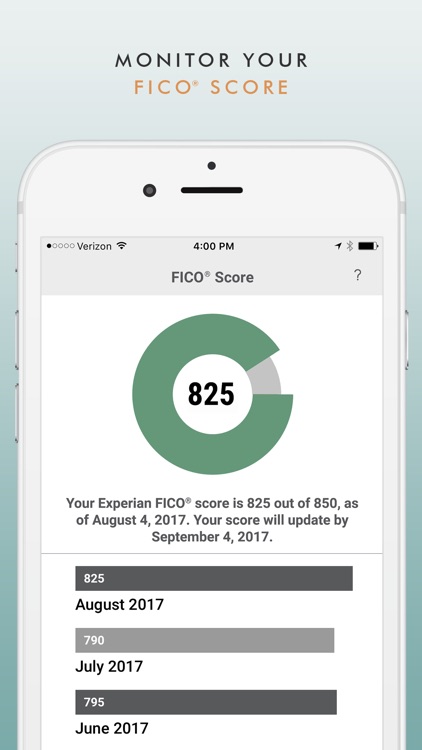

Loan providers prefer fico scores with the deluxe (regarding 700+ range). Which profile is employed within an extensive buyer character, helping determine whether a borrower are ready to pay right back the totality of home financing according to the name agreements.

Lower results (600 otherwise less than) can lead to large https://paydayloansconnecticut.com/hartford/ interest levels, otherwise ineligibility having protecting a loan at all, while the lenders may possibly not be as the confident in this new debtor.

As a result of Experian, TransUnion, and you will Equifax, borrowers can found one to totally free credit report a-year, highlighting, on top of other things, its fico scores, that should idea them towards in which it substitute the brand new sight of mortgage brokers.