DOJ ine perhaps the lender know or have to have understood you to definitely particular information about the application are incorrect otherwise false but still processed the mortgage

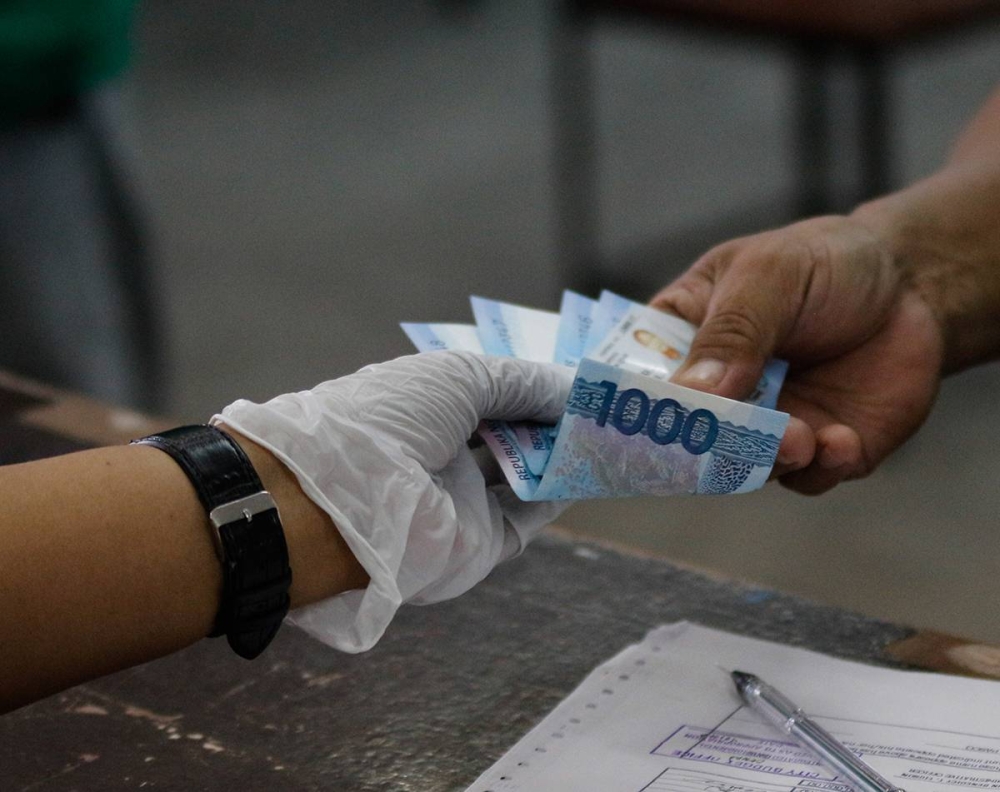

On , the us government revealed it founded an excellent $670 million financing program from the Payroll Coverage System (PPP) to simply help companies through the COVID-19 pandemic. At first sight, the process of providing such loans seems apparently easy. Alternatively, this step have proved not to simply be complicated and you will vulnerable so you can error, nonetheless it can also put financial institutions and other lending organizations needlessly below an effective microscope. While doing so, PPP mortgage qualification recommendations seems to changes frequently, just leading to this new suspicion whenever giving such loans.

Additionally, small enterprises recorded multiple legal actions and class actions facing finance companies, together with You.S. Lender and you can JPMorgan, about their management of PPP loan applications 2 . Additionally, legal actions had been recorded moaning about the bill out of PPP fund from the more than eight hundred in public-replaced businesses saying that including funds was intended for small enterprises or other litigation was indeed recorded contrary to the You.S. Small business Government (SBA) having usage of bodies ideas indicating whom acquired the funds. Nevertheless other individuals one to received resource charged new SBA additionally the You.S. Service of one’s Treasury alleging that SBA regulatory recommendations contradicted particular arrangements of your own CARES Act and you can, thus, was ultra vires and you will gap. Considering the extensive participation about PPP in addition to level of currency involved, finance companies and other loan providers will continue to face analysis which they click for more need to be happy to address.

DOJ therefore the SBA have established the intent to research whether the experience from individuals into PPP applications was basically correct and you can accurate. Every PPP fund more than $2 mil might possibly be closely examined by Treasury Agencies to own compliance. Untrue skills with the a beneficial PPP software by borrowers, no matter if built in good-faith, can lead to municipal otherwise unlawful accountability. The fresh PPP training one to authorities was closely exploring become: the number of teams, the level of the brand new borrower’s payroll (that is used to determine the borrowed funds count), and perhaps the financing are necessary to help with constant team businesses of the applicant.

The PPP application for the loan was processed either from the a financial otherwise because of a financial loan company. As no. 1 ideas custodian for running PPP loan requests, financial institutions would be prepared to found subpoenas or any other guidance requests regarding the authorities agencies. The brand new subpoenas tend to consult a general set of files regarding bank’s arms or manage, and they will require suggestions in accordance with each other borrower and you can bank.

The new Agency from Fairness (DOJ) recently announced step 1 an intention in order to proactively browse the and you will target PPP mortgage ripoff

The majority of the fresh requested advice might possibly be always test this new accuracy (we.age., corroborate) or oppose all the information that was recorded on borrower’s application. A good subpoena also can consult composed and you will digital interaction within financial and you may debtor. For example, internal or external characters on whether or not to remain or get back a great PPP financing might have to be manufactured unless a legitimate advantage applies. Together with a subpoena for data, DOJ also can require bound testimony men and women employed in control the loan. Issue concerning if a lender otherwise financial is to notify a borrower you to definitely their recommendations might have been asked or subpoenaed by government stays discover. Really county statutes need subpoenas so you can banking institutions having bank accounts otherwise additional information be offered so you’re able to individuals or consumers to object to help you conformity.

Immediately, its unsure if or not banking institutions could be held responsible to own handling fraudulent PPP programs. SBA recommendations (a meantime Final Laws) says one to lenders will get rely upon borrower representations generated with the PPP application forms. That it aids the scene one to loan providers may not be held accountable to have operating programs that contain misstatements.