Very first introduced very early this year to possess refinancers by greater Newcastle Higher Mutual (NGM) Class, Newcastle Permanent’s digital lenders accommodate quicker approvals, having loans getting accepted in the since short as 20 minutes.

To guarantee the simple loan application techniques plus the secure handling of borrower studies, Newcastle Long lasting collaborates having OCR Laboratories, DocuSign, illion, CoreLogic, LendFast, and you will Loanworks within the providing the latest electronic home loan provider.

NGM Group President Bernadette Inglis told you technical have a vital role when you look at the safeguarding the latest timely turnaround with the digital lenders.

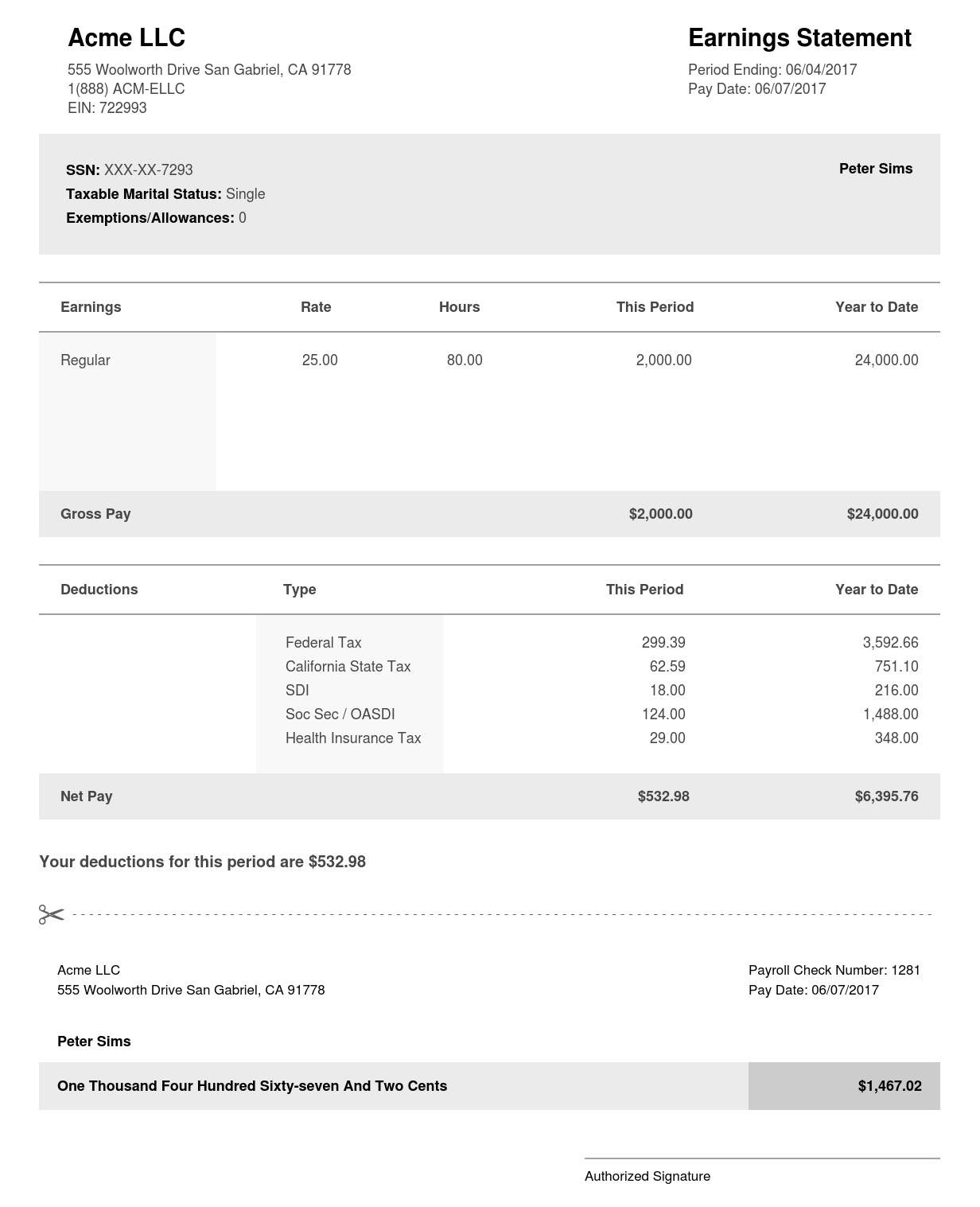

Thanks to the service’s cutting-edge tech, you do not have to own people to by hand assemble records for example just like the lender comments, payslips and you will ideas of monthly using our very own secure platform helps collate this particular article, she told you.

Newcastle Permanent captain shipping manager Paul Juergens said digital financing, that makes up to 5% of the group’s home loan conversion process, is anticipated to enhance rapidly.

We’ve drawn our day, very first starting in order to refinancers to ensure the platform are strong and prepared to deal with a bigger level of apps, the guy told you.

We have been thrilled supply this towards the greater sector, like so you’re able to more youthful Australians, whom we acceptance have a tendency to drive need for electronic mortgage brokers.

We feel which have our very own people available for users if they need assistance is key to ensuring he’s got a delicate feel, the guy said.

There isn’t any area having an electronic digital mortgage providing if the a beneficial buyers gets crazy, gets up and feels the need to are located in a department anyway we aren’t recognize ourselves if that’s the method, the guy said.

Score let finding the optimum mortgage

Since 1995 we’ve been enabling Australians learn about owning a home, evaluate home loans and also have help from financial experts to find the right home loan in their eyes.

Your Home loan

- Article Advice

- Promote with our team

Mortgage Analysis

- Contrast Mortgage brokers

- Refinancing Lenders

- Money spent Money

- Very first Domestic Customer Money

Hand calculators

- Resource Development Taxation Calculator

- LMI Calculator

- Financial Calculator

Lenders

The complete markets wasn’t believed in choosing the above mentioned factors. Instead, a cut-down portion of the market might have been sensed. Particular providers’ items is almost certainly not obtainable in most of the states. To be felt, this product and you will speed need to be demonstrably composed into equipment provider’s web site. , , , , and performance Drive are included in the new InfoChoice Classification. In the interest of complete disclosure, this new InfoChoice Category is of this Firstmac Classification. Learn about exactly how Infochoice Classification handles potential issues of interest, also exactly how we receives a commission.

Pty Ltd ACN 161 358 363 works due to the fact an Australian Financial Properties Licensee and you can an enthusiastic Australian Borrowing from the bank Licensee Number 515843. was a general recommendations vendor plus providing standard tool recommendations, is not and also make one idea otherwise testimonial on the people types of product and all sorts of business issues might not be thought. If you sign up for a cards tool noted on , might package in person that have a credit seller, and never with . Pricing and you can tool guidance should be confirmed into the relevant credit seller. To learn more, see is the reason Monetary Attributes and you may Borrowing from the bank Book (FSCG) What considering constitutes guidance which is standard in nature and has never taken into consideration any private expectations, finances, otherwise needs. can get receive a fee for activities shown.

Important info

provides standard suggestions and you can comparison qualities in order to create advised economic conclusion. We do not defense all tool otherwise seller on the market. Our service is free of charge for you once the i found compensation out-of unit providers to have sponsored positioning, adverts, and you can information. Significantly, this type of industrial dating dont dictate our very own editorial stability.

To get more more information, delight refer to our very own How exactly we Receive money, Dealing with Problems of interest, and you will Article Recommendations profiles.

Editorial Stability

On , the audience is passionate about helping Australians make advised economic work tirelessly to offer exact, relevant, and you may objective information. We pleasure ourselves with the maintaining a strict s, making certain that the content your read is based strictly on quality rather than determined by industrial appeal.

Advertiser Revelation

All of our services is free of charge to you, by way of assistance from our people as a consequence of paid positioning, advertising, and you will suggestions. I secure compensation by the creating activities, referring your, or once you simply click a product hook. You can also pick advertisements inside emails, sponsored stuff, otherwise directly on our site.

Unit Publicity and Types Acquisition

We try to cover a standard product range, organization, and you will functions; but not, we do not coverage the whole sector. Products in our comparison dining tables are arranged centered on various issues, together with device enjoys, rates of interest, costs, dominance, and you will commercial preparations.

Specific things could well be designated because the marketed, seemed or sponsored and could come prominently throughout the dining tables irrespective of of its services.

Concurrently, particular issues may present versions built to send one to associated organizations (e.g. the large financial company lover) exactly who may be able to help you with things in the brand you chose. We might discovered a payment for that it referral.

You could potentially customise your hunt playing with our americash loans Kirk sorting and filtering devices to help you prioritise what counts most for your requirements, while we do not examine most of the provides and several efficiency associated which have industrial agreements may still come.

Analysis Rate Alerting and you will Foot Standards

To have lenders, the bottom conditions were a $five hundred,000 loan amount more than 3 decades. This type of costs are merely instances and may also not were all charge and you can charges.

*The new Investigations price is dependent on a good $150,000 financing over twenty five years. Warning: which research price is valid only for this example that will perhaps not become the costs and you can fees. Different terminology, costs or any other loan amounts can result in the a unique assessment rates.

Monthly Payment Numbers

Month-to-month repayment numbers is actually prices that ban charges. These types of estimates derive from brand new advertised rates towards given name and you may loan amount. Actual payments will depend on your circumstances and you will interest change.

Monthly costs, because the foot criteria try altered by representative, depends toward picked products’ stated prices and you can calculated of the loan amount, payment form of, financing term and you will LVR once the enter in by representative/your.