Home improvement funds are probably one of the most well-known financial support programs to own home owners looking to fund house solutions, reericans need certainly to redesign their houses but do not have the profit the bank to cover brand new strategies so finance to own house advancements have become common selection.

What exactly accomplish? Well, the financing markets was loosening upwards dramatically throughout the recent years, so you might have more options to money their recovery than simply do you believe. Of a lot people don’t understand there are numerous options available so you can mee your circumstances to support the better financial support for renovations whether you are renovations, landscaping otherwise doing complete-blown structure.

Most Do it yourself financing are believed next mortgages, because they are a second lien at the rear of the first lien to the identity for the possessions.

Discover more in order to think do-it-yourself funds that have unsecured money, HELOCs, home security fund, cash-aside re-finance mortgage loans and you will bodies attempts off FHA.

Brand new RefiGuide often match your that have best loan providers to examine a knowledgeable home improvement financing prices online.

You could search and evaluate cash out refinancing, household equity outlines, 2nd mortgage loans and you will unsecured consumer loan apps that meet your needs to finance renovations prices-effortlessly.

Evaluate the brand new lender’s customer care tips and you can browse viewpoints away from past and present borrowers to ensure they aligns with your financial need and you will do-it-yourself goals.

Particular 2nd lenders bring affordable do-it-yourself mortgage rates having zero closing costs off lending fees, helping borrowers to attenuate expenses like circumstances, origination charges, later percentage costs, prepayment punishment, control costs, underwriting charges and more.

What is actually a home Update Mortgage?

Owning a home have a tendency to comes with a list of ideas and developments you would want to deal with and work out the space warmer, functional, or attractive. This is where a home improvement loan will be a valuable financial support. Why don’t we diving on the what do it yourself funding are and how they helps you alter your living space and you may property’s well worth.

A loan to own renovations is actually specifically planned to greatly help that have covering significant home-related will set you back or any systems on purpose of during the improving your room. Using this type of financial unit, there is the methods to finance a broad spectral range of endeavors, should it be a comprehensive family restoration or perhaps the renovation off good certain area.

At the same time, the bucks acquired by way of such as for instance home improvement fund can be utilized to deal with very important needs that raise up your daily life high quality, including fixing a leaky roof, setting-up a share, updating a keen antiquated Heating and cooling system, or resolving plumbing work problems.

How-to Examine an informed Do-it-yourself Loan Now offers Today

When looking for an informed do-it-yourself money online, it is important to explore your options and you will pre-qualify which means you contain the capital one to greatest matches your aims.

Apr (APR): APRs involve the complete cost of the loan, nearby people lending payday loans no credit check Monroeville Alabama charges that lender or finance source might enforce. Whenever you are a card relationship member, its good initial step. Federal credit unions, most of the time merely enforce a max Annual percentage rate off 18%.

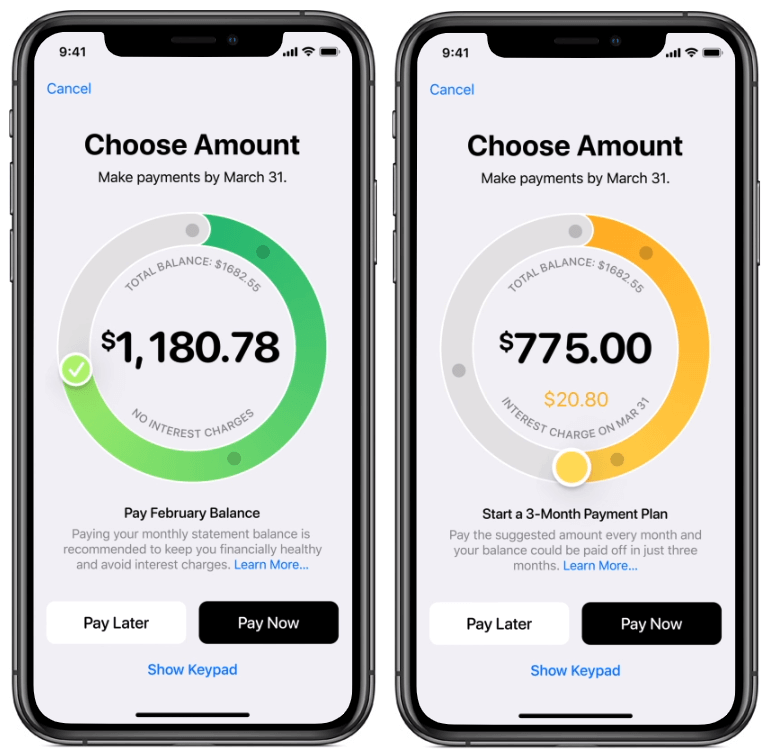

Payment: Even if you safe a reduced-second financial rate of interest, it’s vital to make sure the monthly obligations line-up along with your funds. Incorporate a home update finance calculator to ascertain the top loan count, rates, and you may cost label that will produce a manageable monthly payment.

Loan amount: Specific do it yourself loan providers set an amount borrowed restriction, (anywhere between $20,000 to help you $100,000). For many who enjoy assembling your shed have a tendency to exceed this type of limits, search for a loan provider that accommodates huge loan amounts. Really consumer loan loan providers promote mortgage amounts one range between $ten,000 in order to $fifty,000.