No money away greet

Consumers should be accredited very first time homebuyers that happen to be on process of to get one loved ones hold into the area limitations of City of Drain. An initial time homebuyer is one or domestic who has got perhaps not had a property as their no. 1 home for the last three years (unless he or she is good displaced individual).

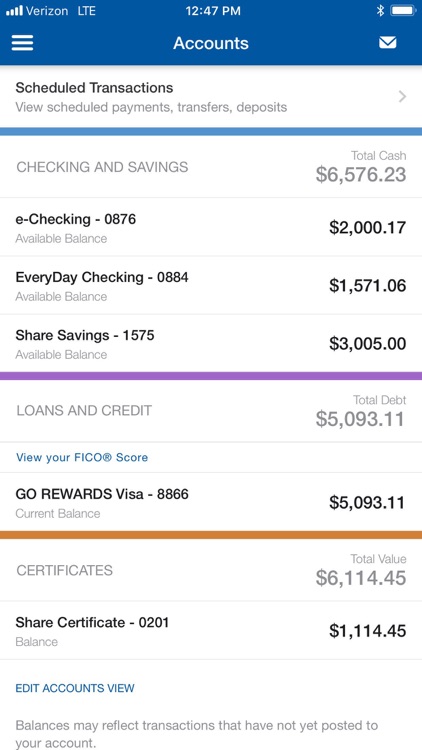

Debtor need to meet the money qualifications restrictions set from the program so you’re able to qualify for Town guidelines. House money ought not to go beyond the interest rate prescribed by the Oregon Casing and you can Society Services on the Oregon Bond system out of $64, for a-1 so you can dos person house otherwise $74, for step 3 or even more people from the home (these number try susceptible to alter).Total household earnings form the earnings of all of the owners regarding your family. In the intimate off escrow, homes try not to keeps liquid assets more than $eight,.

Borrower should provide enough documentation of income to your City to own use in determining the fresh borrower’s income peak. Last determination of a keen applicant’s earnings top and program qualification will become only discernment of Urban area or City’s agencies.

Debtor need to fill out a complete app at least a month previous to their planned personal out of escrow. On determination away from qualification toward system, debtor will discovered a letter stating the maximum amount of loan money a buyer is approved having. Which letter find eligibility merely. As the funding is limited and that’s on a primary become basic suffice foundation, a letter off eligibility isnt a make sure that money tend to be around towards the debtor whenever asked.

Debtor should provide money during the a cost comparable to the very least of 1% of your purchase price for usage because the a down-payment. These financing can be a gift. Such loans should be set in escrow before personal and you may evidence of way to obtain funds sent to the town just before disbursal of City funds.

Homebuyer need efficiently done a neighborhood recognized very first time homebuyer studies system and you can financial fitness degree ahead of the personal from escrow.

Priority will be made available to individuals who live and/or are employed in the town out of Drain. Opted authorities and you will Urban area workers are qualified and ought to end up being preapproved by the Urban area Council.

Home ordered should be current single family unit members residences discover during the urban area constraints of Town of Sink. House available in almost every other towns or even in the fresh new unincorporated city inside or close the town out-of Drain dont be eligible for the latest program.

House purchased must be solitary-family relations residences. Are designed residential property need to be with the a permanent base and you can are made residential property inside parks dont be eligible for the program.

Consumer need to obtain a composed property check statement out-of a qualified house assessment team ahead of the romantic from escrow. So it statement need to defense all the big bad credit installment loans South Carolina options in your house and additionally but not limited by electricity, plumbing system, fundamentals, water drainage possibilities, painting, and all of situated-inside appliances. Home need certainly to ticket a bug and you may dry rot evaluation and you will meet basic safety criteria.

Borrower should enter a loan contract towards the Town of Sink since the full quantity of financing lent of the Area. A great promissory notice between the visitors together with City describing brand new financing words is going to be performed in addition to a deed away from trust having selling constraints. Incapacity from the borrower to conform to new regards to the newest promissory mention and you may/otherwise faith deed may result in brand new default of your City’s mortgage.

Loan shall be subordinated only for price and label refinances (no cash out) at the sole discretion of City

Interest during the a predetermined rate of five% shall accrue to possess a period of ten years right after which big date no extra desire might possibly be billed. Commission off accrued interest might be deferred and due in addition to the principal from the duration of transfer away from name or re-finance.

Financing loans may be used in order to buy property and to fund one nonrecurring settlement costs of this getting the home. Customer should maybe not play with loan money to invest in solutions, room enhancements or even purchase one low-real-estate.

Full loan number and you can settlement costs may not meet or exceed this new decreased regarding sometimes 99% of your appraised property value your house or 99% of the price. Which should be verified prior to the romantic of escrow thanks to the fresh new entry regarding an assessment statement prepared by a licensed genuine property appraiser. The brand new appraisal must have started done 3 to 5 weeks earlier on the romantic away from escrow.

Earliest mortgage loans need to be repaired rate finance no negative amortization, balloon money otherwise variable price possess. Urban area supplies the authority to reject acceptance away from that loan oriented on negative regards to the initial mortgage.

Rewarding the aforementioned standards is the just duty of your homebuyer. Inability to completely match the over program standards because the dependent on the town otherwise City’s representative may result in a delayed when you look at the resource or perhaps in mortgage assertion.