loans in Iona

Ensure you get your Files Managed

You’re must prove you can undertake the new duty out-of a home mortgage. To prove your ability to buy property, you will need the following:

- Proof of label (images ID, constantly the drivers license otherwise a passport)

- Proof of a job and you can money (paystubs, W2’s / taxation statements for a couple of many years)

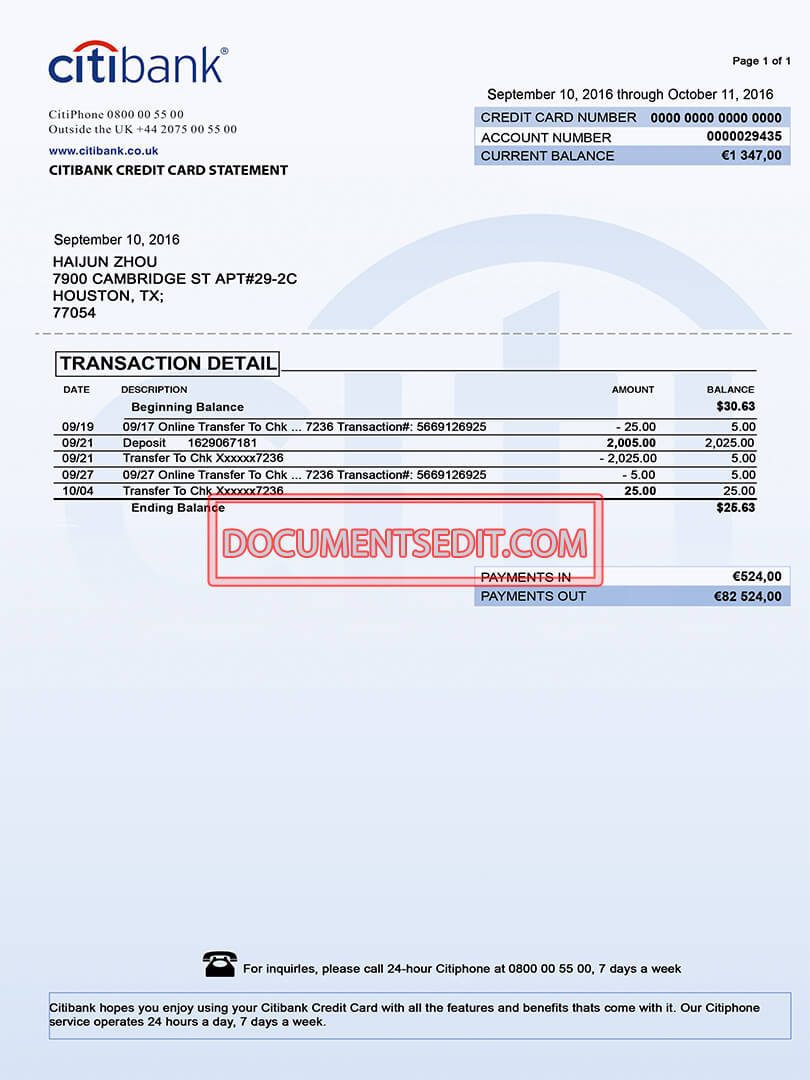

- Proof assets ( 2 months lender statements however, consider, it’s not necessary to has 20% down)

- Evidence of credit history (a woeful credit rating cannot instantly exclude providing financing)

Done a loan application

Completing a loan application can be simply over on line with a lot of loan providers. Using the suggestions more than you’ll have everything your need finish the software on the best of your capability. Act as while the exact as you are able to; in case you may be being unsure of if you are reacting a concern precisely, don’t worry as this is perhaps not your final app. A loan Officer might be evaluating that which you shortly after submission and you will go through products which they need clarified.

Doing a credit card applicatoin will not obligate that coping with you to definitely particular bank, and cannot charge you any cash at the start. However, before going from the app processes, you need to be positive that we should work at brand new bank you might be completing the applying having. Should it be contrasting on the internet otherwise talking to a loan Manager past to help you doing the applying, you may want to accomplish best due diligence.

Get Preapproved

Once you complete the loan application, the financial tend to request the brand new support documentation in the list above to verify and you can confirm all the details you may have provided. A great prequalification is simply examining everything your go into for the application, and you may estimating how large of loan you’ll be able to be eligible for. A good preapproval was a far more comprehensive overview of your revenue, assets and credit. For the preapproval techniques, your borrowing from the bank was drawn, your information try affirmed, and it’s based that you are a serious candidate.

Very a good Real estate agents inside the a busy business will demand good preapproval in advance of demonstrating your house, and you can one supplier before taking an offer may wish to get a hold of an effective preapproval letter that demonstrates you should buy the house. Good Sammamish Home loan Manager (LO) helps you rating preapproved to help you initiate home browse confidently.

And make an offer/Earnest Money Put

After you’ve discovered the best house, you might be ready to create a deal. When you look at the negotiation procedure and possess an authorized give, timelines now start working, and receiving what you lined up in a timely fashion is important to using a soft deal. Among the first strategies are a deposit of one’s earnest money discussed about contract to your escrow. It constantly is actually step one-5% of your own cost based on how aggressive the fresh list are.

Certified Loan application

Once your provide are acknowledged, the next strategies happen quickly. Fundamentally, your own contract commonly indicate you have a certain number of weeks so you can formalize a software and start the mortgage processes having a specific lender.

Hopefully you already compared rates having lenders you find attractive performing with, while the so now you is always to complete this decision. Sending a copy of purchase and you will purchases arrangement with the financial and you may allowing them to discover you might be happy to proceed is enough if you have already completed an application to own preapproval.

Financing Possibilities and you may Securing a rate

Immediately following you happen to be lower than offer and have now decided to progress having a loan provider, the loan Administrator is always to inform your together with your newest speed and you can cost selection. Preferably, their bank has actually an online equipment enabling one look for real-date rates and you can costs so you have a notable idea regarding what is around currently.