Active-obligation services players keeps dramatically down homeownership rates than the general populace. These low costs was mostly said because of the demographics away from the present active-obligation provider people-they are young, is varied, and move appear to-however, raising the All of us Institution away from Pros Facts (VA) financial system may help a lot more service members and pros get belongings.

During the detection from National Armed forces Appreciation Times, i talk about advantages and you can downsides of your Virtual assistant financial program in the present higher-interest-price ecosystem. Even in the event Va financing could offer lower down payments and you may home loan desire pricing than many other apps, manufacturers tends to be less likely to take on also offers of customers participating about system.

Even after present system advancements, both the Va and you may federal policymakers you will definitely perform far more to make sure this new Va home loan system assists those who have offered its nation buy home, build riches, and maintain their houses in times off financial hardship.

Benefits associated with this new Va mortgage system

Virtual assistant mortgage loans generally need no down-payment. In comparison, Government Construction Management (FHA) mortgages wanted step three.5 percent down, and authorities-paid company (GSE) funds require step 3 percent to possess borrowers that have all the way down incomes otherwise 5 per cent to possess consumers that do perhaps not be considered once the low income. Considering 2022 Home mortgage Disclosure Act (HMDA) research, 73 % out of Va consumers set 0 % down when selecting a home.

Virtual assistant mortgages generally cost a lower amount than other mortgage loans. According to 2022 HMDA data (2023 analysis are not fully available), the brand new average interest rate on the Va loans are 4.75 percent, compared with 4.99 per cent into the conventional money and you may 5.13 percent into FHA loans.

Virtual assistant money in addition to encountered the littlest express off fund having appeal costs a lot more than eight % and also the largest show away from loans which have prices lower than 3 per cent. The real advantage of Virtual assistant fund is likely larger, since prices dont echo the fact that specific consumers that have GSE mortgage loans should have personal home loan insurance rates. Rates toward FHA financing also dont are the program’s yearly 0.55 % mortgage top.

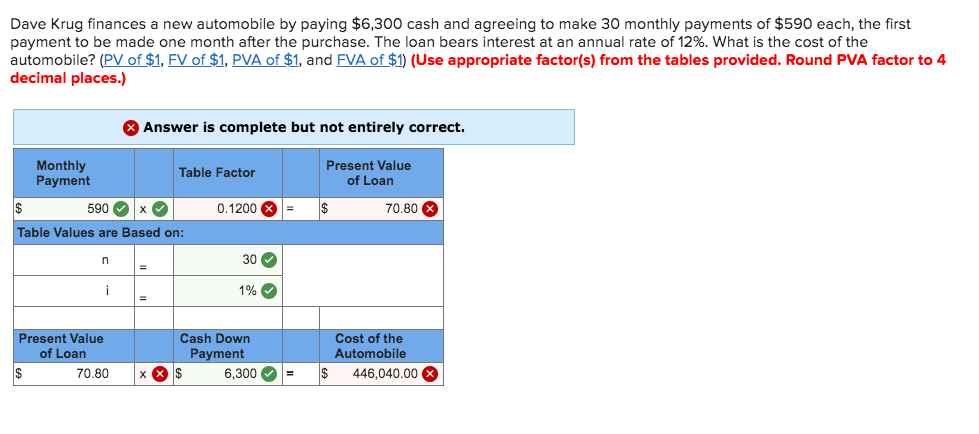

Eventually, Va finance keeps lower denial cost, long lasting borrower’s competition or ethnicity. Historically excluded from homeownership or other riches-building potential, groups of colour continue to have all the way down homeownership prices than simply white parents. But the racial homeownership gap is actually faster among experts and services members compared to this new nonmilitary society. https://cashadvanceamerica.net/title-loans-in/ Assertion prices is somewhat down certainly Black colored and you may Latine Va house mortgage candidates in contrast to Black and you can Latine individuals trying to get other variety of finance.

Drawbacks of Virtual assistant mortgage system

Basic, people home becoming bought which have a good Va mortgage have to be examined because of the good Va appraiser who guarantees the house adapts with the minimum possessions requirements: it ought to be structurally voice, safe, and you can sanitary. When your property does not see this type of standards, owner need to create fixes before loan is signed. Such as for instance, in case your roof was leaky, the borrowed funds you should never close. In comparison, old-fashioned funds do not require all about home inspections, meaning a buyer you may buy a home wanting fixes for a cheap price.

Virtual assistant appraisals will take more time than simply regular domestic valuations.In addition, whether your assessment value is lower compared to the conversion rate, the vendor need certainly to reduce the price towards appraisal worth, and/or purchases usually do not go ahead. Having a conventional financing, not, the new parties can also be renegotiate the purchase price and/or consumer can pay the essential difference between the fresh renegotiated price additionally the appraised value. This provides the vendor much more liberty should your domestic fails to appraise.

From all of these additional barriers, specific vendors are unwilling to sell to borrowers whom depend towards the Virtual assistant resource. While the housing marketplace has cooled off due to the fact pandemic, of numerous house nevertheless score multiple bids. Whenever suppliers keeps alternatives, they often times avoid Va funds. Outside of persistent misconceptions regarding the program, sellers most often cite our home review requirements and the assessment procedure because factors they are unwilling to sell to Va consumers.

In the long run, losings mitigation for disappointed Virtual assistant mortgage individuals is smaller powerful than simply to have consumers which have GSE otherwise FHA financing, and this ensure 100 percent of one’s amount borrowed, weighed against a Virtual assistant loan’s 25 percent be sure. Whenever a debtor which have an FHA otherwise GSE loan feel financial trouble, the brand new borrower is also pause mortgage repayments for some time. This type of missed costs are going to be paid instantly or even in this new short term, put in the conclusion the loan term, or along with a modification propose to slow down the borrower’s costs.

From inside the pandemic, the brand new Va provided comparable applications to the an emergency base, however these apps effectively ended within the 2022 (PDF). The Va will quickly launch a separate losings mitigation program, although solutions it will provide for stressed individuals are still a whole lot more restricted compared to those offered by most other agencies. Expanding loss minimization alternatives for Va consumers may help of numerous active-obligation solution members and you can experts end foreclosures and climate financial hardships.

Current system developments tend to dump traps, but far more action is needed

Once the 2019, this new Va has brought tips to attenuate barriers produced by the brand new assessment processes. When the an enthusiastic appraiser anticipates a beneficial valuation become lower than new transformation price, the brand new appraiser is needed to alert the new debtor and provide the new real estate professional, financial, or borrower 2 days available considerably more details you to definitely supports the fresh amazing conversion process speed. In the event your ensuing assessment is still underneath the conversion rates, the fresh borrower or bank normally consult a great reconsideration useful away from the fresh new Va. As well, when you look at the , this new Va expected comments into the rulemaking alter who does greatest fall into line lowest assets requirements that have industry-wide property standards.

Toward , the newest Virtual assistant tend to discharge this new Pros Facts Upkeep Get (VASP) program, that may allow department to invest in defaulted Virtual assistant money when another loss mitigation selection was exhausted. Such VASP funds can get a 2.5 percent interest rate, be kept because direct money regarding the VA’s collection, and start to become serviced because of the VA’s special servicer. As a result, the program enable stressed Va individuals to receive a home loan amendment with an installment protection. Nonetheless, specific business trading communities has shown concerns about the mandatory conformity deadline to possess mortgage servicers ().

Homeownership is vital so you can building intergenerational riches in the usa. To simply help more active-responsibility solution players and you can experts feel and stay homeowners, policymakers ought to provide this new Va to the expert and you will resource needed which will make losings mitigation software you to definitely match the GSE applications.