Unlocking the best refinance terms

Refinancing your own mortgage feels like matchmaking-inquiring just the right inquiries initial will save you a whole lot of dilemmas in the future. payday loans Five Points Just as you wouldn’t invest in a relationship without knowing new concepts, dive for the a good refinance without the right inquiries will cost you big-time.

Bad and the good moments to help you refinance

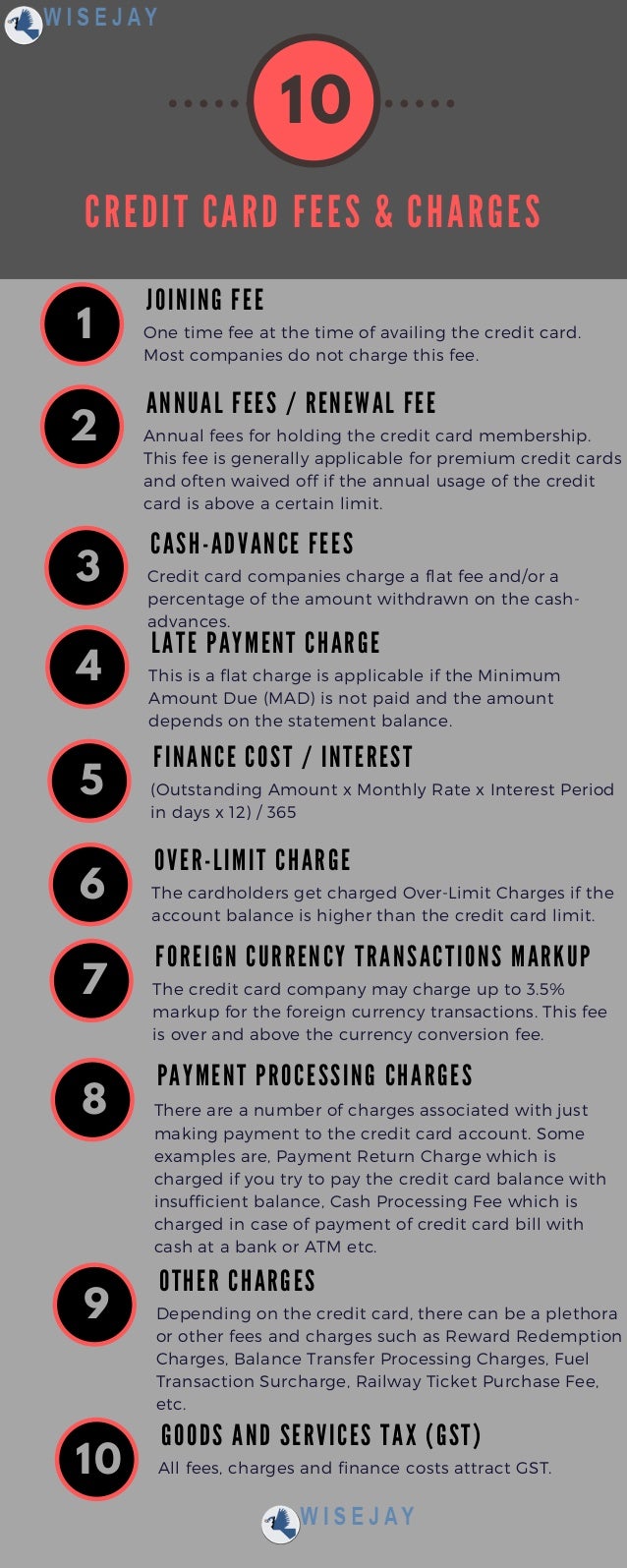

There are times – when financial prices try falling prompt – when refinancing is actually a no-brainer. Delivering your rate is at least 0.5% less than your existing that, refinancing is normally of good use.

And, out-of , financial pricing were toward a definite downwards development, even though there were enough peaks and troughs in the act. So, extremely homeowners refinanced occasionally.

Source: Freddie Mac, 30-Seasons Repaired Rate Mortgage Average in america, retrieved regarding FRED, Government Reserve Financial out-of St. Louis

But, given that start of the 2021, up until this information is authored, home loan pricing had been toward an ascending trend. And fewer citizens had been refinancing.

Fannie mae reckons that, within the day conclude , the buck level of re-finance applications are down 88.6% versus refinance boom that occurred into the third quarter regarding 2020.

- And work out a top monthly payment

- Stretching-out the amount of time they might be purchasing their property, constantly incorporating notably towards the complete matter their attention will surely cost them

Without a doubt, we-all desire to understand the come back off a falling trend inside financial rates; property owners could save thousands. However it had not but really turned up if this blog post is composed.

When refinancing excellent even after rising cost

Refinancings can be rarer than simply they were in the past however, they’ve far out-of gone away. Some individuals however score rewarding benefits from them. So, what might men and women getting?

Well, periodically, an individual who closely inspections mortgage cost you are going to place the current financial rate are 0.5% lower than its current rates. Then, they may create an effective rate-and-term refinance, that will send a lowered home loan rates without extending the entire loan title.

Cash-out refinances is a beneficial

But, additionally, it’s because somebody need a profit-aside re-finance. You alter your present home loan with more substantial that and you may walking out which have a lump sum of the improvement, minus settlement costs.

If you’re refinancing so you can more substantial mortgage at the a higher level, discover noticeable drawbacks. You’re extremely gonna score a much higher payment and the price of credit order your family rockets.

That is not certain. Eg, whether your credit score is significantly higher and your debt obligations less than after you removed your mortgage, you will be offered the lowest price. But your economic activities could have needed switched in order to rating next to compensating to have home loan rates’ rising development.

You might be able to average the outcome in your month-to-month fee (sometimes even score a diminished you to definitely) by extending enough time you’re taking to pay down your property loan.

Including, suppose your existing 30-12 months home loan could have been opting for twenty years. If you get a different sort of 30-seasons mortgage, you will end up distribute your instalments over 50 years. Which will help along with your monthly payments however, will send the new full amount you have to pay inside the interest sky-high.

Therefore, why refinance? Since the sometimes you would like a money injections so terribly that the (primarily deferred) pain is worth they. Imagine you may have crippling expenses one threaten every aspect of the lifetime, as well as your family. Otherwise that you’ve come an alternate dollars-starving business. Or you are all of a sudden facing an inescapable and you will unplanned partnership.

Maybe a money-aside refinance is the best possible way send. But, before deciding on that, listed below are some family guarantee loans and you may house collateral credit lines (HELOCs). With our 2nd mortgages, your existing mortgage remains set up and also you shell out increased rates simply on your own new borrowing.