By way of over the years low interest rates, it is a fantastic for you personally to combine loans and have now some more funds on your pouch from the refinancing your residence. Contact us to see if refinancing makes sense for your requirements right now. We is plugged in and able to help – simply grab your financial statement and you will agenda a visit with Blue Liquids today.

What exactly is Refinancing?

Refinancing occurs when home owners take-out a new mortgage to help you exchange the established that. The fresh loan upcoming pays off the original mortgage. According to your goals, refinancing your property financing can lessen your own monthly obligations that assist you know significant, long-identity coupons.

When Is-it Really worth Refinancing? seven A few

You will be asking: Can i refinance my household? Here are 7 points you should consider when you find yourself contemplating if refinancing is sensible to you:

- We want to benefit from low interest rates.

- You have high-attention personal credit card debt you’re looking to settle.

- The fresh new collateral of your property has grown and you will become able to get eliminate PMI.

- Your debts has changed. Maybe you’ve altered professions or obtained a paycheck improve?

- You are looking to help you combine their other sorts of personal debt, eg a unique financial, figuratively speaking otherwise car and truck loans.

- You’re thinking about while making renovations otherwise repairs.

- The borrowing have improved, meaning you may be capable of getting a much better price actually when the prices haven’t been down.

Benefits associated with Refinancing home financing

Refinancing gift ideas a good possibility to get a different home loan which is top ideal for your current lives and you can budget. A few of the significant benefits of refinancing are:

Refinancing will also improve your loan terminology. This may mean moving out of a 30-year financing to help you a 25-12 months loan so that you can repay the borrowed funds and you may very own your home quicker. By eliminating your loan terms and conditions, you are along with lowering the level of desire you need to shell out your own bank.

After you finalized their first loan terms and conditions, you agreed upon a particular interest rate (fixed or adjustable) attached to the borrowing from the bank number. Refinancing involves lowering you to interest, thereby decreasing the number of appeal might spend towards the dominating.

With down monthly obligations and you can a lower rate of interest, refinancing can bring nice a lot of time-label discounts. Including, consolidating all bills when you refinance can make it easier to handle your money.

Exactly what are the Costs associated with Refinancing?

Refinancing makes sense if you intend in which to stay your existing house for a long time, however the process do incorporate specific will cost you. The main of them become:

- Origination charge plus application, points, and you may financial costs

- Term look and you may insurance policies

ten, 15 & 30-12 months Repaired Speed Mortgages into the NH, MA, Me, VT, CT, RI, NC, CO, Carlton bad credit payday loans no credit check Florida, Tx, GA & Sc

Repaired rates mortgages care for a fixed interest rate on lifetime of one’s financing, unlike money where in actuality the interest rate is adjusted.

Refinance Mortgage Pricing: State-by-Condition Analysis

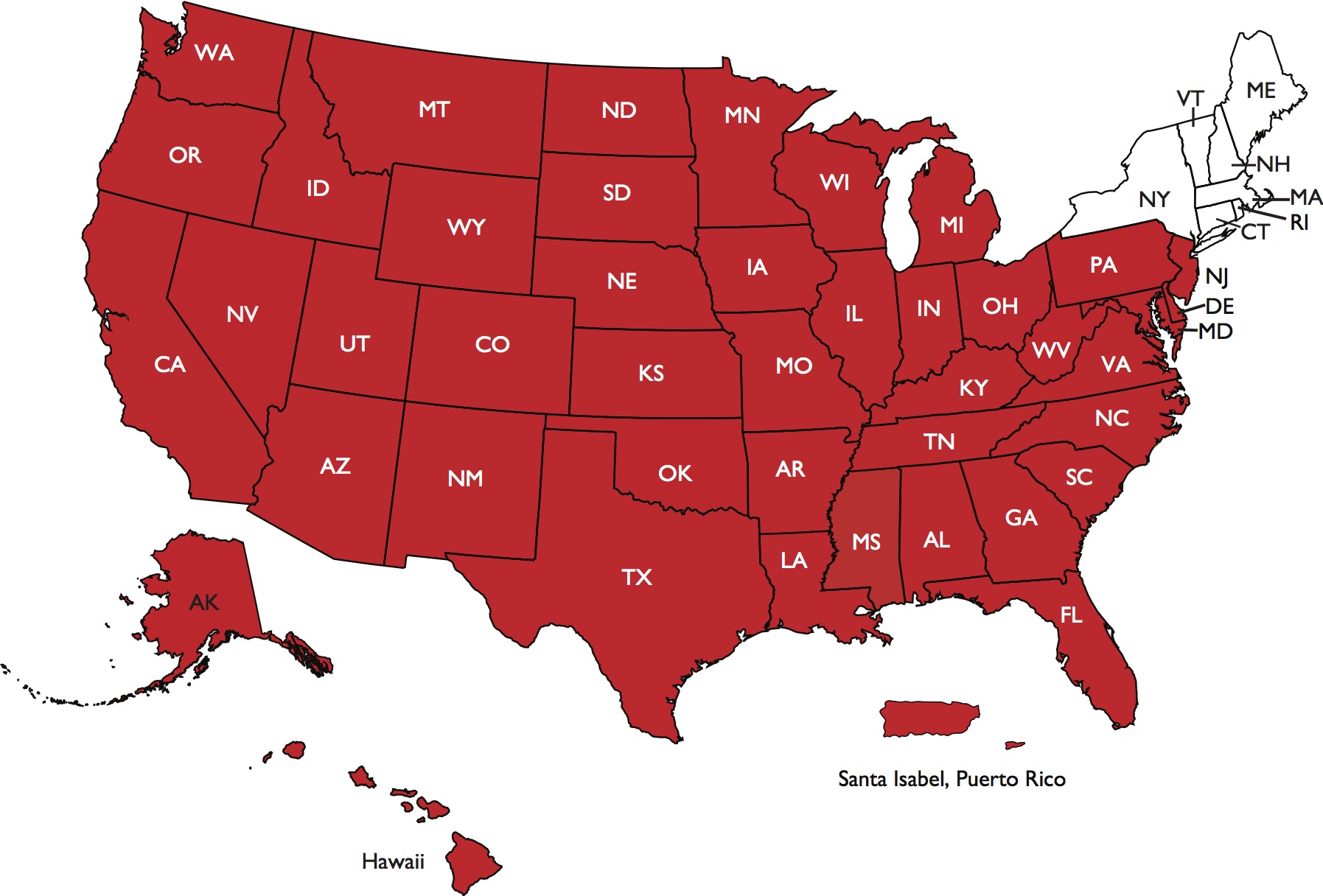

Blue-water Mortgage is actually licensed into the The fresh new Hampshire, Massachusetts, Maine, Vermont, Connecticut, Rhode Isle, New york, Texas, Fl, Tx, Georgia, and you will Sc. Once the mortgage refinancing process is similar all over the country, there are numerous distinctions:

Refinancing Changeable-Speed Mortgage loans vs. Fixed Pricing

A changeable speed home loan, also known as a varying speed otherwise tracker mortgage, is actually home financing with an adjustable interest. No matter if Fingers will have a varying interest along the loan’s lifespan, they do possess a period of time to start with where you will find uniform, repaired payments minimizing 1st interest rates. This era can last from a month to many years. A supply initiate down but could quickly rise above the fresh fixed-rates home loan (FRM) eventually. An arm is an excellent brief-term solution, however necessarily a long-label solution.

After this period, the rate often to alter within an excellent pre-determined volume, which is repaired to own a specific amount of many years immediately after which adjusts on a yearly basis thereafter.

An FRM retains the same interest on the loan’s lifetime, hence protects you against month-to-month homeloan payment develops due to rising interest levels. The total amount you are going to pay monthly hinges on the home loan conditions.