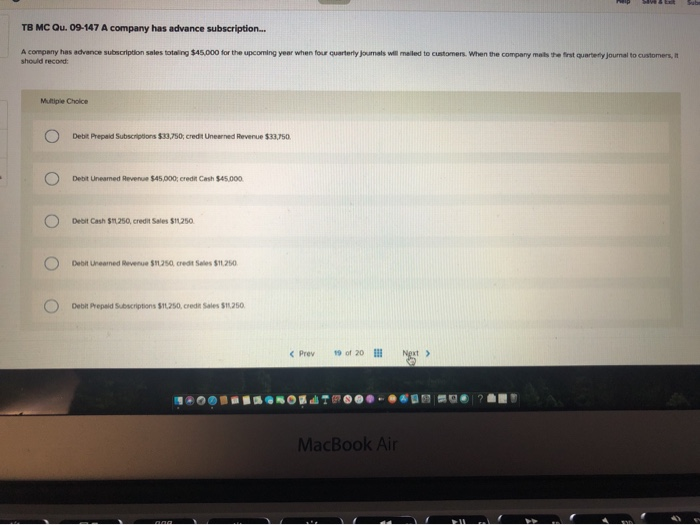

Comparable to real estate transactions, not, you really have difficulty trying to find a lender so you can agree you which have a get lower than 580.

You believe you could front-action credit history requirements having a keen FHA Improve Home mortgage refinance loan. Based on FHA Streamline legislation, the lender is not needed to look at your borrowing, ensure your revenue, otherwise purchase property appraisal in advance of granting you for a beneficial refi.

Actually, although not, of a lot loan providers commonly read the borrower’s credit anyhow. Bear in mind, lenders wish to know they might be and come up with a secure wager when they provide money. Your credit score is a big element of that decision-making processes.

Having a keen FHA bucks-aside home mortgage refinance loan, you’ll https://paydayloancolorado.net/johnson-village/ want to do have more than simply 20% collateral of your house at minimum a 580 FICO get. Very FHA loan providers lay their unique constraints large to provide an effective lowest rating of 600-620, even though. The reason being bucks-away refinancing is generally reported to be higher risk than simply low-cash-aside refinance fund, if you don’t a property purchase.

FHA against. antique mortgage credit scores

Old-fashioned fund generally need a credit score from 620 or even more. Whether your credit rating is gloomier than just 620, an FHA mortgage tends to be your sole option.

An element of the drawback the following is that most FHA loans need mortgage insurance rates. FHA financial insurance is known as MIP, or mortgage insurance premium. In the event the downpayment is less than 20%, old-fashioned financing additionally require mortgage insurance also known as personal financial insurance rates, otherwise PMI.

FHA financial insurance premiums are very different according to the down-payment. Even so, the difference on the advanced is actually negligible; the brand new annual MIP rates drops regarding 0.85% so you’re able to 0.80% once you create a down payment of five% or maybe more.

Having conventional funds, however, straight down credit ratings not merely imply high interest rates as well as somewhat large home loan insurance premiums. It means mortgage insurance policy is usually cheaper to your an enthusiastic FHA financing than just a normal mortgage getting consumers which have reasonable borrowing from the bank.

As an instance, let’s say you’ve got an effective 620 credit rating and you are clearly putting 5% upon property having fun with a keen FHA loan. To get the equivalent premium having a normal financing and you can merely 5% off, you might you desire an excellent 700 credit rating.

Bear in mind that with both FHA and you can traditional fund, less credit history mode higher rates. Although not, a top interest rate is not the prevent of the globe. For many who work on your borrowing, you may be able to re-finance the loan for a reduced rates soon.

Even more FHA loan standards

Also minimum credit rating requirements, FHA fund possess additional requirements to have individuals. Luckily, these types of requirements try less stringent than the antique financing.

- Inhabit the home since your first house

- Follow FHA mortgage limitations , which are less than conventional mortgage limitations

- Features a reputable credit rating no less than several oriented borrowing from the bank account

- Provides sufficient and verifiable money

- Violation a keen FHA appraisal completed from the a keen FHA-accepted appraiser

- Satisfy lowest assets standards making sure your house is safer to live on inside and will maintain worth through the years

One which just accomplish your loan, you should get preapproved with many other FHA lenders in order to find out more about the recommendations, rates of interest, and upfront costs. Following buy the financial that may ideal meet your needs and you can price.

Your upcoming measures

When your credit scores are reasonable, or you don’t have a huge downpayment, cannot lose hope. Despite all the way down score, an FHA loan is the services for finding into your dream household.