Casing Funds are offered regarding Area 19(5) of one’s Retirement Finance Act, Zero 24 away from 1956 through Lender from South Africa and you may all software to own houses money is cared for by financial with regards to the National Credit Operate (NCA), No 34 off 2005.

Your retirement Supported Credit unit (PBL) even offers an alternative way to suit your company to help group so you’re able to meet the construction needs. Which have a pension Recognized Credit financial, staff is also financing their houses from the leveraging the fresh coupons he’s got built up within their old age money.

That have negotiable monthly repayments and you may a primary linked interest, your staff could have usage of houses finance one costs the fresh new exact same or even below mortgage-backed fund, that will not involve bond subscription otherwise assets valuation will set you back and you may doesn’t rely on the business worth of the house or property worried.

Your business can improve worker really-are and gratification, and construct support and no influence on your debts piece and you will minimal effect on peoples resource administration.

It is Participants & Municipalities’ duty to stick to the fresh new contract to make certain that the brand new payments is subtracted and paid so you’re able to Financial institution.

33% of the member’s user express try supplied due to the fact a guarantee because of the the new Funds in order to Financial institution. If a member enjoys R100 000 user express as a result the fresh new particular member gets an optimum loan away from 33% hence compatible R33 333 regarding indicated condition. The fresh new available 33% off representative share are different relative to individual value of representative show

It subsequently means a part has to collect a part display from R15 000 so you’re able to be eligible for that it benefit.

Is to a part utilize this business such as in the next seasons from inside the office, their mortgage continues to be calculated more than an excellent 5 12 months period. The new affiliate need to make money towards the leftover three years from inside the work environment of that respective term. If the user getting re-selected to your workplace from the this new identity the remaining repayments have a tendency to getting moved to the original 2 years of the the new title.

Will be a part never be re also-decided once the first label and thus only paid down three years the remaining matter becomes subtracted regarding Member share before brand new players choosing their money.

For each town must done a performing on the behalf of the the Councillors that element of MCPF verifying that the municipality agrees in order to deduct the costs in advance of users acquiring its salaries. This undertaking must getting gone back to Standard bank Pension Powered Casing Money prior to their users applying this facility.

Because previously mentioned carrying out has been obtained of the Standard bank PBL participants are now able to submit an application for its houses money. The brand new completed forms making use of the help data files is always to up coming getting delivered to their related Practical PBL work environment.

Standard bank PBL Loan application requirements

- Participants to-do a keen Application and you will Money & Expenditure entirely

- Participants to add copies of your adopting the: Duplicate regarding https://paydayloancolorado.net/lake-city/ ID file Duplicate out-of ID file of partner in the event the hitched within the community from possessions Consent page out-of partner in the event that partnered within the society out-of property Evidence of home-based target perhaps not older than three months ninety days Payslips 3 months Proof of financial information Retirement Money representative work for declaration Estimate away from topic in the event the boosting/renovating/strengthening otherwise Bring to acquire in the event that to invest in property or empty residential property The significantly more than to get faxed so you’re able to 011 981 8885 / 011 981 8812 or emailed in order to

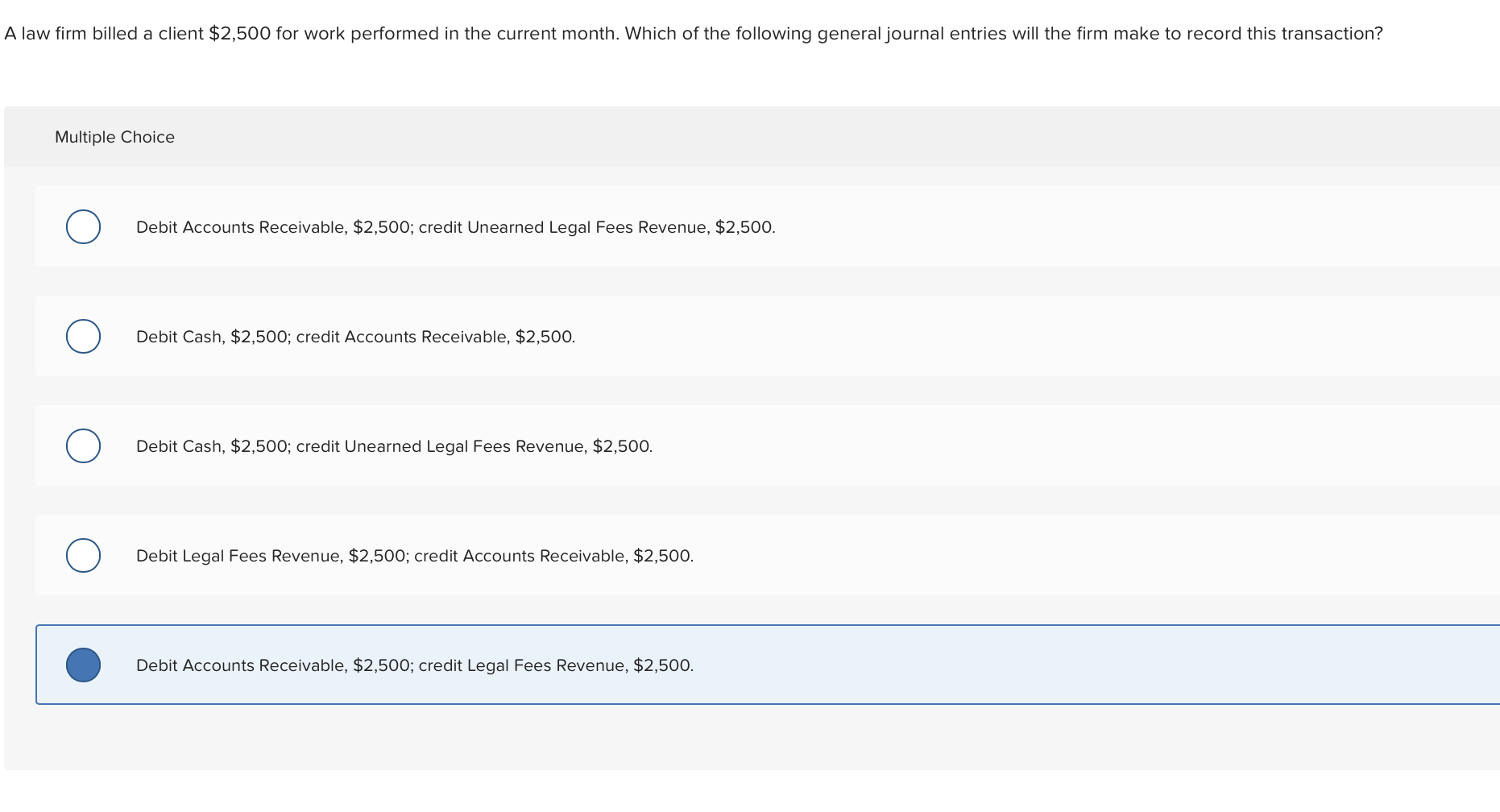

After Standard bank PBL receives the application, the procedure is below:

- Representative pertains to Standard bank PBL to have loan.

- PBL vets software to possess cost and you may performs NCA monitors.

- Software effective users told and app passed so you can Satisfaction Experts

- Pleasure Associate matches having affiliate and performs an associate expertise i.t.o. NCA debtor and you can member sign the loan contract

- Financing arrangement gone back to Financial and you may sent to Loans for consent and you can number flagging

- Mortgage agreement gone back to Financial performs a last see and pays away the loan to help you associate.

- In the event the loan is actually refused for reasons uknown affiliate informed by Sms