Freddie Mac computer Pupil Construction Fund include $5 million – $100 billion (regardless if huge and you will reduced loans are considered), possess LTVs doing 80%, and gives versatile, non-recourse terms and conditions ranging from 5-ten years (to 30 to have low-securitized, fixed-price finance).

- Individualized Freddie Mac computer-Covered Multifamily Loans to possess Pupil Houses Qualities

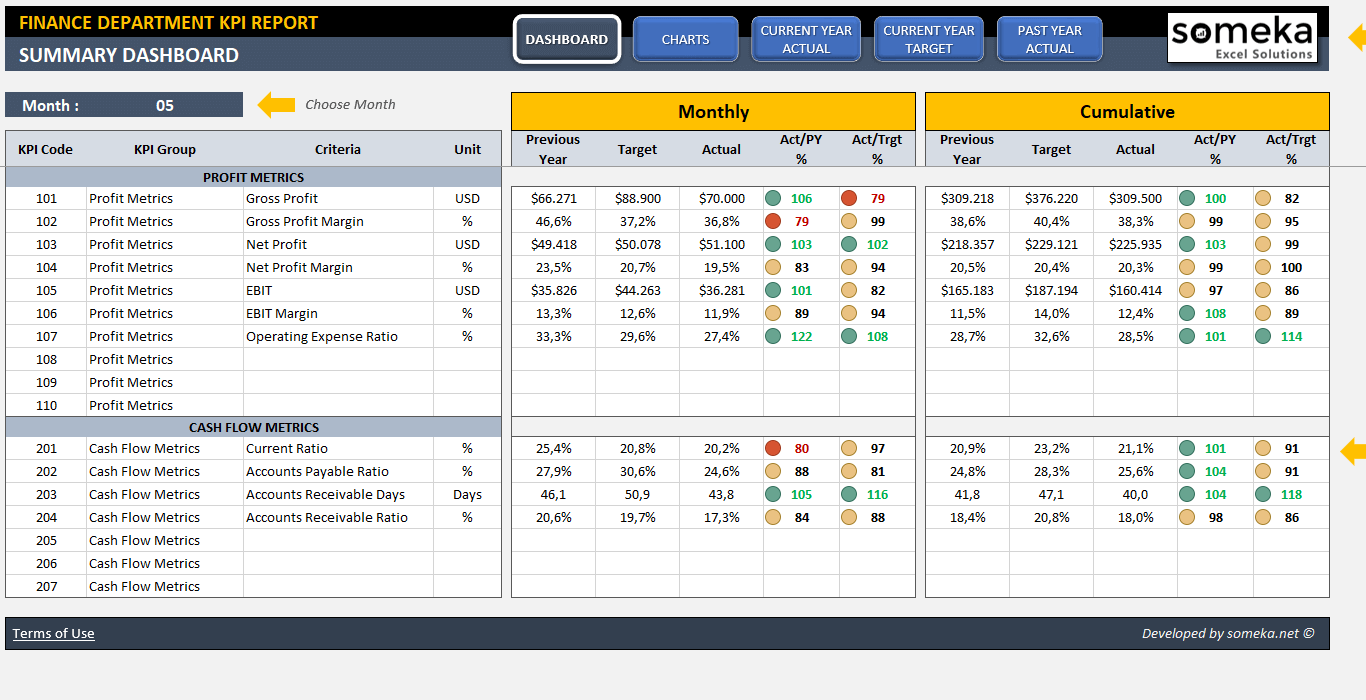

- Test Freddie Mac Conditions to have Pupil Housing Money when you look at the 2024

- Qualified Individuals

- Qualified Characteristics

- Professionals

- Drawbacks

- Example: And then make a respect-Incorporate Enjoy in Gainesville

- Get Financing

That have many people througout the fresh You.S., there clearly was not ever been a better for you personally to purchase the fresh new scholar housing industry – and you may Freddie Mac will be here to aid.

Having Freddie Mac computer College student Homes Financing, investors and you can builders may help render property for the next age group of American frontrunners, thinkers, and you can doers, all the when you find yourself being able to access LTVs as much as 80%, flexible mortgage regards to anywhere between four and you may ten years (otherwise to 3 decades for low-securitized, fixed-rates finance), and you can Freddie Mac’s credible, non-recourse financing delivery. Also, Freddie Mac Scholar Casing Funds including make it supplemental resource and invite very early rates-lock and you may directory-secure solutions so you’re able to dump risks to possess borrowers.

Keep reading below for more information, or click here so you can download the effortless-to-learn Freddie Mac Pupil Casing Loan term piece.

Prepayment Selection: Yield repairs up to securitization, 2-seasons secure-away several months following securitization, defeasance desired shortly after securitization. Produce maintenance to have securitized financing try permitted to own an additional percentage. No pre-fee advanced needed in the past 3 months of your own financing.

Assumability: Finance is assumable having financial approval, however, need a 1% presumption payment repaid to Freddie Mac computer. Can also wanted an enthusiastic underwriting percentage paid back towards the financial (usually doing $5,000.)

Qualified borrowers become restricted partnerships, limited liability organizations, corporations, or an excellent tenancies in keeping (TICs) that have ten or fewer members

In a number of points (with specific conditions), standard partnerships, REITs, limited-liability partnerships, and many trusts can also be eligible

Usually, consumers must be single purpose organizations (SPEs), not, into fund lower than $5 mil, individuals could probably feel Unmarried House Entities rather

Qualified Functions

“Purpose-dependent college student casing attributes; need to have no less than one toilet for every single two rooms, and each apartment must have another type of full kitchen”

Refinancing Attempt: Zero test needed for amortizing fund with a good DSCR out-of on least step one.40x and you will an LTV out-of below or equal to 65%. Interest-only loans must citation good refinancing decide to try in advance of he or she is accepted.

Disadvantages

Demands 3rd-group profile along with Phase We Environmental Comparison, Appraisal, Physical Demands Analysis, Seismic Declaration may be required having attributes during the Seismic Zones step 3 and cuatro. Technologies Statement can also be called for.

Example: And then make a value-Include Play for the Gainesville

Regarding the bustling college town of Gainesville, Fl, local a residential property developer, Eagle Vision Assets, accepted a large options in the beginner housing industry. Having a strong student people during the School from Florida, there is certainly a routine need for sensible, safer, and you will easily discover scholar houses. It understood a mid-increase strengthening, below a couple of miles regarding school, which they you will definitely transfer to the a state-of-the-art scholar casing state-of-the-art.

However, the cost of order and restoration is actually generous. It expected an established financing lover exactly who know the fresh new student construction industry that can let them have a big financing into the favorable terminology. It discover the solution from inside the Freddie Mac’s College student Casing Financing program.

The house or property they planned to purchase and you can remodel try cherished during the $8 million. With Freddie Mac’s Scholar Houses Loan system, Eagle Eyes Financial investments was eligible for an enthusiastic 80% LTV towards the a great eight-season financing, translating to the a loan away from $6.4 mil.

The loan given a competitive rate of interest and a 30-seasons amortization period, offering the providers having lowest, down monthly premiums. At the same time, Freddie Mac’s low-recourse loan delivery was instance attractive, providing coverage facing private liability.

Eagle Vision Financial investments was also interested in the first rate-lock solution that the mortgage system given. This invited https://paydayloancolorado.net/laird/ them to secure the rate at the beginning of the borrowed funds procedure, securing them up against potential speed increases before closure date.

On Freddie Mac Scholar Housing Financing, Eagle Attention Financial investments properly received and you will refurbished the property, making it an active college student casing advanced having modern services. Not simply did your panels yield good return on the investment, but it addittionally provided definitely with the regional college student housing industry, approaching a significant you want for the Gainesville’s society.

This monetary connection with Freddie Mac try important for making the brand new enterprise an endurance, showing the tremendous property value this new Scholar Houses Mortgage system to own developers and investors regarding pupil housing industry.