Share this short article

CLEVELAND , /PRNewswire/ — Today, KeyBank launched this provides financed over $one million when you look at the KeyBank Neighbors Basic Loans, providing two hundred clients loan places Brilliant reach the desire homeownership from inside the areas where the application form can be acquired. That it milestone ’s the most recent KeyBank enjoys hit since introducing which program during the .

This new KeyBank Neighbors Very first Credit i is actually a different Purpose Credit System that provides $5,000 with the settlement costs and other pre-paid down costs that can incorporate money a different sort of, owner-filled where you can find homebuyers into purchase of eligible characteristics. Extra costs is home loan, flood and danger insurance, escrow put, a residential property taxes, and per diem focus to have eligible services.

KeyBank’s 2024 Monetary Freedom Questionnaire discovered that of a lot People in america faith homeownership may be out of reach on account of rising will cost you. Of these individuals (20%) who are not currently in the business to get a home and you can have not purchased one out of the past season, 69% trust the fresh new dream about owning a home is not too attainable.

“Simultaneously when of many feel they simply can not afford a good domestic, KeyBank’s perform, specifically with our Locals Earliest Borrowing from the bank, is erasing doubt and you can helping our very own subscribers see just what can be done once they spouse the help of its financial,” said Dale Baker , Head regarding Family Financing from the KeyBank. “Whether or not they would like to buy a different sort of domestic or boost your house he could be into the, KeyBank was dedicated to handling our readers to assist them reach its hopes and dreams and you can goals.”

- Cleveland, OH : 47 loans financed having $235,000

- Columbus, OH : 25 credit funded to have $125,000

- Dayton, OH : eleven credit funded having $55,000

- Albany, Nyc : nine credits financed to have $45,000

KeyBank Attacks Another significant Milestone, Surpassing $1 million in Locals Earliest Loans

The KeyBank Neighbors First Credit is one of three special purpose credit programs (SPCPs) from KeyBank. The KeyBank Homebuyer Borrowing from the bank ii provides up to $5,000 in credits toward closing costs and other pre-paid fees that may come with financing a new home to homebuyers for the purchase of eligible properties in eligible communities. The Homebuyer Credit launched in , Key has funded more than $2.4 million in credits, helping 533 clients.

Likewise, the main Opportunities Home Guarantee Mortgage iii brings sensible conditions to own borrowers that have qualifying functions so you’re able to refinance its number one house so you’re able to good straight down interest rate, combine personal debt, funds home improvements, or utilize its equity when needed. It mortgage provides a predetermined rates, without origination payment, and you will an initial or next lien choice for funds to $100,000 . Because the program began for the , KeyBank financed $13 billion in the financing, enabling 259 customers secure fund due to their first household in appointed communities.

“And make homeownership less costly, accessible and you can, to start with, sustainable is actually a serious section of KeyBank’s intent behind helping the communities we serve prosper,” said Rachael Sampson , Direct away from Area Financial having KeyBank’s Individual Lender. “Cut off by the block, society from the community, we are invested in providing the readers generate wide range and you will develop by giving all of them with info and programs that assist create homeownership you can.”

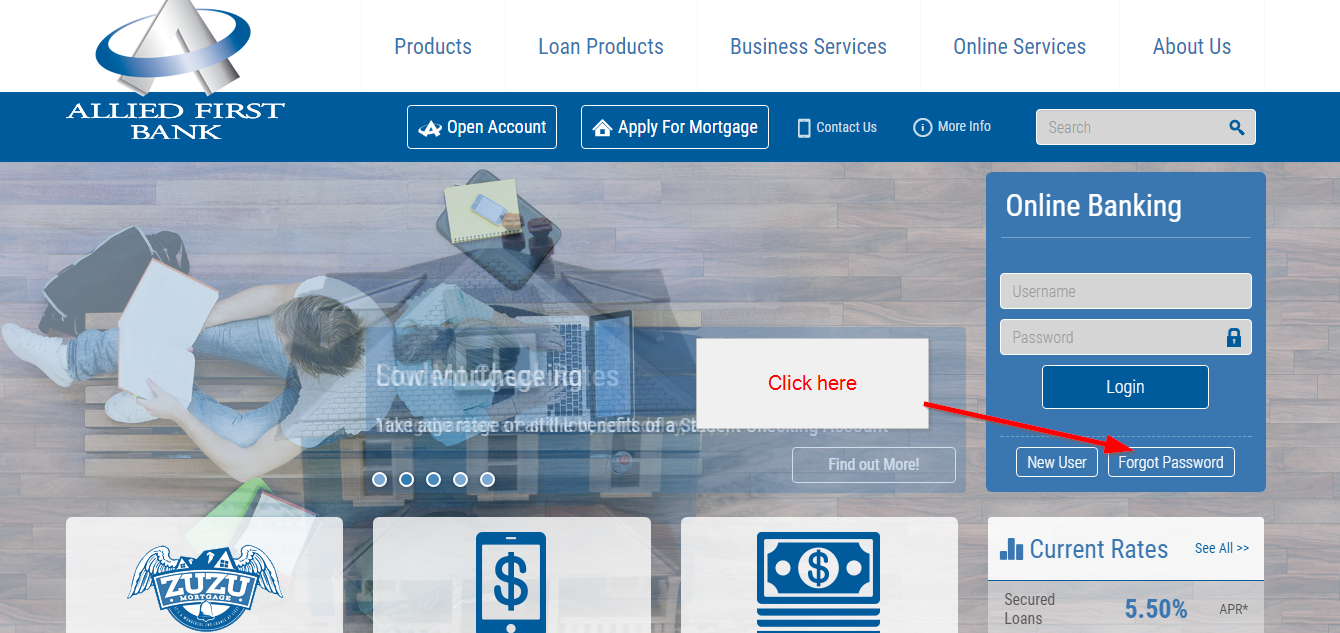

Find out more about KeyBank’s house financing options and you may software, determine whether a house qualifies getting Special purpose Credit Programs, or get started on your way so you’re able to homeownership by going to secret/communitylending. To possess information about the present day state out of local areas and also to answer any questions you have got, also whether or not property qualifies to have Key’s Special-purpose Borrowing Apps, KeyBank Home mortgage Officials are around for assist.

On KEYCORPKeyCorp’s (NYSE: KEY) roots trace back nearly 200 years to Albany, New York . Headquartered in Cleveland, Ohio , Key is one of the nation’s largest bank-based financial services companies, with assets of approximately $187 billion at . Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital e. For more information, visit KeyBank Member FDIC.

NMLS #399797. KeyBank offers borrowing from the bank secure from the residential a home in the place of regard to race, color, religion, federal origin, sex, impairment, or familial reputation. Every borrowing products are susceptible to equity and you may/or borrowing approval, conditions, criteria, supply consequently they are at the mercy of transform.

CFMA #240925-2801809________________________ we On no. 1 household very first lien instructions just. Assets need to be located in a qualified area within the KeyBank’s shopping impact otherwise Florida . Qualified organizations have decided because of the KeyBank and you will at the mercy of changes instead of find. More terms or restrictions may implement. Ask united states for details.

ii On no. 1 quarters basic lien requests just. Assets need to be based in an eligible society because influenced by KeyBank. Qualified Communities is subject to changes without notice. A lot more terms or limitations could possibly get implement. Ask you to have information.

iii Loan features less interest rate no origination charge. Available on established primary residence and you will fund to $100,000 . Earliest or next lien simply. Mortgage must close in a part. Property must be based in a qualified community during the KeyBank’s merchandising footprint. More conditions or restrictions get incorporate. Query us having details.