In an effective bi-weekly commission bundle, the mortgage servicer was collecting half of your monthly payment all 14 days, ultimately causing 26 payments during the period of the year (totaling that additional payment per month a-year). By creating even more repayments and you may implementing your payments towards dominating, you’re capable pay back your loan early. Before you choose a beneficial bi-weekly payment, definitely remark your loan conditions to find out if you might possibly be at the mercy of a great prepayment penalty should you very. Find out if their servicer charge people charges getting an effective bi-per week percentage package. Your e goal without having any fee by making an additional month-to-month mortgage payment annually.

Closing Revelation

It offers the mortgage terminology, your own estimated monthly obligations, and just how much you will shell out inside charge or any other will set you back to get your mortgage.

Framework mortgage

A housing loan can be a primary-label loan that provides fund to purchase cost of building otherwise rehabilitating a home.

Old-fashioned financing

A conventional financing is one real estate loan that’s not insured or protected from the authorities (such as for instance not as much as Federal Homes Management, Agency out of Pros Issues, or Institution away from Farming financing applications).

Co-signer otherwise co-borrower

An excellent co-signer otherwise co-debtor try an individual who agrees for taking full obligation to spend straight back an interest rate to you. This person are forced to spend one skipped payments and also a complete level of the borrowed funds or even shell out. Particular financial applications separate an excellent co-signer as the someone who is not toward name and you may really does have no possession demand for the newest mortgaged household. Having an effective co-signer or co-borrower in your mortgage loan gives their lender most warranty that the mortgage was paid back. But your co-signer or co-borrower’s credit score and you can finances is located at exposure if not repay the mortgage.

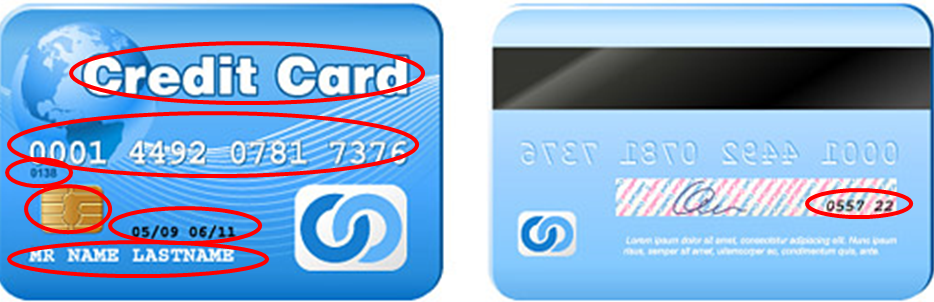

Credit history

A credit rating try monitoring of their borrowing from the bank levels and you will your own reputation for expenses on time since found on your own borrowing report. Individual reporting people, also known as credit scoring enterprises, gather and update details about the credit score and gives it with other enterprises, which use they build conclusion in regards to you. Credit history possess facts about the borrowing from the bank activity and you can newest borrowing disease just like your mortgage paying history additionally the status regarding their credit levels.

Credit report

A credit report try an announcement who’s details about the borrowing hobby and most recent borrowing from the bank condition such mortgage using background and the position of one’s credit membership. Loan providers use your credit scores while the details about your borrowing report to see whether your be eligible for financing and you may exactly what interest rate to provide.

Credit score

A credit rating forecasts exactly how probably you are to expend back that loan on timepanies have fun with an analytical formula-entitled a scoring model-to help make your credit score from the recommendations on your credit report. You can find various other scoring habits, which means you don’t possess a single credit score. The scores count on your credit report, the type of financing equipment, and even the afternoon whether or not it are calculated.

Loans ratio

The debt-to-earnings proportion is your own monthly personal debt money split by your terrible month-to-month income. It number is one way lenders scale your capability to deal with new monthly premiums to settle the cash you intend in order to use.

Deed-in-lieu out of foreclosures

An action-in-lieu of foreclosure is an arrangement in which you voluntarily start control of your home toward lender to avoid the latest foreclosures process. An action-in-lieu off property foreclosure ount remaining towards home loan. If you reside in a state the place you try in charge when it comes to deficit, which is a big difference between the value of your residence and you may extent you still are obligated to pay on your own home mortgage, you ought to pose a question to your bank so you’re able to waive the new deficit. When your bank waives the brand new deficiency, obtain the waiver in writing and keep it for your details. A deed-in-lieu regarding foreclosures is the one brand of loss minimization.