Believe, next, your seventy-five years old, don’t have any need for mobile devices, and get merely acquired resource from the truly finalizing report loan documents which have a pencil

2nd, take-all the point-of-product sales fictional character simply discussed and you may envision a home-to-doorway seller attempting to hard-sell you one thing costly that you none want nor you desire. This is, such as, a solar power-energy program, pergola otherwise gazebo, pest-handle subscription, otherwise triple-pane windows items that could cost $30,000 or maybe more. You want them to go away however, are not an aggressive people and they just continue speaking more than your. Brand new aggressive sales representative asks you, for example, when you can manage a payment away from only a few-hundred or so cash and you may requires you to definitely very first their ipad to ensure that you can aquire certain dismiss. You really have no clue you to definitely, by simply touching a very nearly blank ipad display screen with your fist, you with regards to the salesperson initiated a great $twenty-five,000 loan to pay for this new solar system your didn’t most need.

It, according to research by the experience of the latest lawyer in the Bell Laws, LLC, was a totally reasonable situation. As the particular situations below hence like situations gamble away could possibly get well differ, they tend to express some common threads:

In the event you, for whatever reason, end up on the victim’s stop away from a fake financing, no matter what real circumstances, you can consider the adopting the corrective tips:

- Elders is actually preyed up on inside the outsized proportion;

- New transactions happen easily, have a tendency to not as much as worry;

- An individual does not know the provider desires to create a loan immediately, will because of the electronic pill;

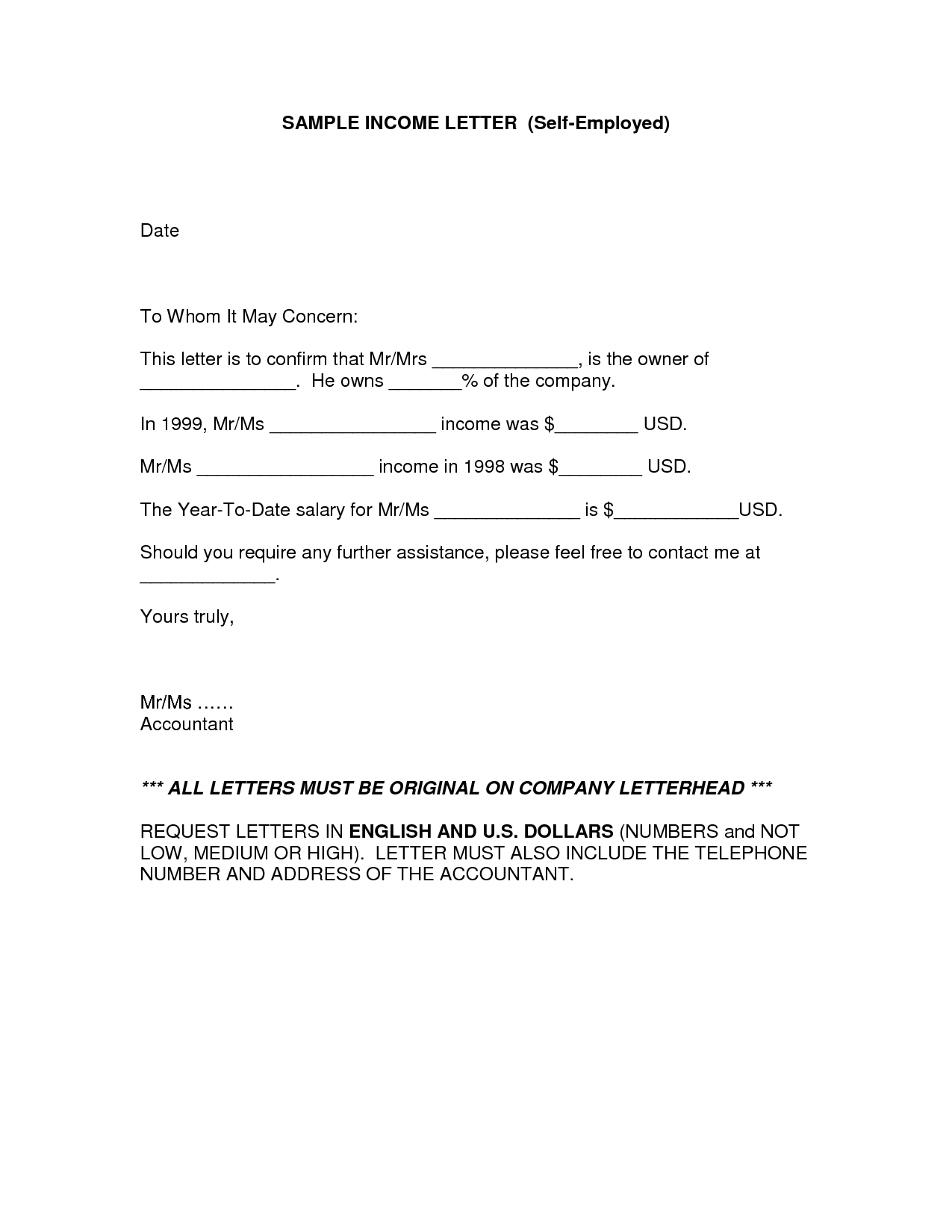

- The consumer are pregnant a global antique mortgage documents or charge, in order to read later on this particular try allegedly proven to https://paydayloansconnecticut.com/deep-river-center/ them into tablet;

- An individual doesn’t also want financing;

- Brand new transactions were the consequence of a home-to-home solicitation otherwise time-delicate scenario, particularly a pest infestation or plumbing system leak;

- The retailer isn’t qualified to determine investment terms and conditions otherwise alternatives;

- The retailer conceals, or even overtly lays regarding the, secret regions of the brand new deal, such its correct cost; and you can

- The financing organization trained the retailer in order to upsell you.

This final point are an interesting you to definitely and you may requires a separate dynamic permitted from the convergence of resource and you can promoting. Which is, as opposed to a borrower proactively going to a lender to apply for a financial loan about traditional trend, point-of-purchases financial institutions match this new resellers. It’s the resellers by themselves who build money and that are the customers of financial institutions. Therefore, these types of financial institutions want household-improvement contractors to sell your far more (upsell you) in the interest of producing many large finance, and certainly will both instruct the resellers tips take action more efficiently.

Even the best tip having to stop being the prey out-of a good fraudulent domestic-update financing is to keep in mind that particularly employing will take lay digitally. This in addition to, in the case of an unwanted solicitation, simply saying no. It’s a good idea to not sign, or even touch, a merchant’s tablet unless you can see it clearly and understand that you may be signing an alleged contract. Don’t simply rely on the merchant’s version of what you’re seeing. While you may well still have a legal claim even if you do sign, or sign, a fraudulent digital contract, it’s probably easier if you simply don’t sign it at all unless you feel confident in what you’re signing.

Do not let the merchant make use of your serious pain otherwise impulsiveness. Aggressive salespeople, regardless of industry, thrive by pressuring people so that they sign a contract just to relieve that pressure. If you have a termite infestation or leaking toilet, you may feel compelled to sign anything just to have it fixed. But, similar to an auto mechanic holding your vehicle hostage for increasingly expensive repairs that you don’t understand, aggressive home-improvement contractors may take advantage of your compromised situation.